Development workers with targets to meet and reports to write know all too well the challenges of working with Government machinery as part of a project at the state, district or even at the village levels. The rigorous worker will anticipate the delays as his file crosses many desks. He will know who to meet and when as he vacillates between patient indulgence and righteous indignation in the effort to loosen the noose around a good idea so that implementation can be justified as passable.

Project implementation plans assume this bureaucratic culture as one of the undeniable constraints of working in the field. Practitioners realise that this dense intricate quagmire is like a seamless horizon which cannot be circumvented or punctured, and hence, many an innovative strategy has emerged to coddle, cope with, co-opt, conspire or collaborate with the bureaucracy on the path to meeting development goals.

Accountability Initiative’s (AI) work on understanding governance is inspired by an appreciation of the above frustrations and efforts at solutions. It is based in the same acceptance of the middle-layer of management in the Government being an intrinsic part of all implementation at scale.

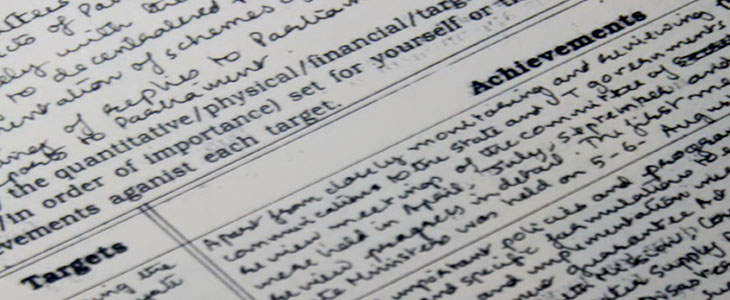

AI studies the layers of middle management in the Government that practitioners are so familiar with, taking care to experience, document and analyse each layer, before peeling it away to start work on the layer beneath, until it gets to the bottom of the issues.

The objective is to twofold.

First, it is to create a knowledge bank that practitioners can use to better navigate the way they construct and implement solutions with and for the Government, and second, it is to pursue a reform agenda of its own.

AI has become part of the implementation teams at the Rajasthan and Bihar Governments, and with an NGO partner in Bihar that support SMCs, so as to get under the skin of the processes as they are experienced by each stakeholder. It has entered each arrangement, as an equal and contributing partner, offering nuanced knowledge, tools and practical suggestions to aid contexualisation of solutions. Being present as a neutral, in-house, compassionate sounding board to each stakeholder, provides AI the opportunity for its only purpose, which, is to gain insight that can support improved policy decisions.

In Rajasthan, AI has an arrangement with the Sarva Shiksha Abhiyan (SSA) to observe the challenges faced by the education management (state level through to the head masters of six individual schools), as they cope with their task to foster School Management Committees (SMC) to become tools for accountability. In exchange, AI trains the headmasters to introduce fiscal literacy to the SMC members.

Across Bihar it is supporting the National Rural Livelihood Mission (NRHM) to improve the ability of members of Self Help Groups (SHGs) to hold local Government schools and Integrated Child Development Services (ICDS) scheme accountable. In three districts of Bihar, AI collaborates with the grassroots communicators at Nidan, as they use trusted relationships with the community and parents to negotiate better quality of services in Government schools.

In a series of blogs following this one, the trials of executing well-meaning policy will be discussed. AI will follow the journey of an idea as it changes form in the hands of Government education management. As ideas become policy documents, to when they are conceptualized as programs. When they become Government orders and letters of authority, to when training manuals created by technical experts become capacity building workshops for master trainers. And finally, to the point when these lectures are delivered to unsuspecting villagers. On the other hand, AI will also report on how the last-mile consumer of Government services, experiences these provisions. It will explore what happens when the effort is made to bridge the gaping distance between the intent of policy and the fragmented services received by the citizen.