The Politics of Money: A look into the Finance Ministry’s crusade against Black Money

28 May 2012

Aishwarya Panicker, Accountability Initiative

The recently released ‘White Paper on Black Money’ by the Ministry of Finance was presented at the Lok Sabha on the 21st of May 2012. Having taken some time to read through the rather lengthy document, it seemed fitting for a few words to be written about the report.

The report seeks to address the scale at which unaccounted wealth exists at present and the response of the Government to curb governance and accountability failures (the full report can be found here). It begins with an emphasis on clarifying concepts, followed by a detailed historical perspective on illicit money flows in the last few decades, and also touches on the subject of institutional strength and transparency to restrict illegitimate economic activity.

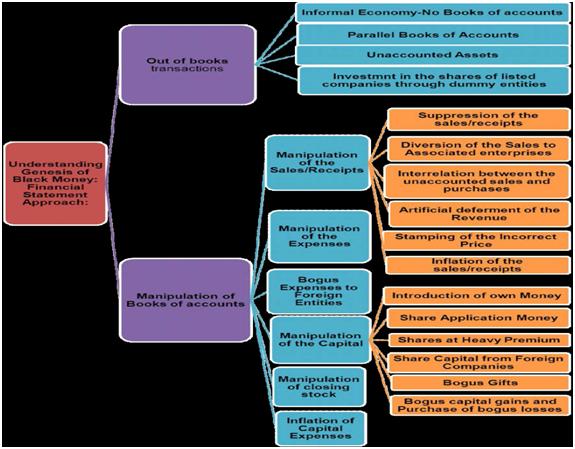

The report looks at black money as ‘wealth earned through illegal means as well as legal income that are concealed from public authorities’[1]. An interesting point made was the level at which manipulation of financial records take place and the procedures involved in misrepresenting particular amounts of money. Here is a snapshot of the various points at which transactions are manipulated and tax is evaded:

Source: White Paper on Black Money (2012)

According to the Global Financial Integrity Report, 2011, the illicit flows out of India have gone up to $104 Billion[2]. The report takes this into account and stresses on a few particular sectors of the economy that are vulnerable to misappropriation of funds- real estate, jewellery, public procurement, non-profit, transfer pricing, tax havens, informal sector and financial markets. While taking a look into the details of each sector, it is apparent that the reader of the report may have gained more insight if more information could have been given on the impact of black money flows in each sector and the subsequent influence on the Indian economy, the extent to which organized crime has penetrated the sectors, any active cases that may be going on as well as the government’s point of view on the growing complex organized crime networks that are now present at the national and international level in these sectors.

The report goes on to elaborate on the several proactive steps taken in terms of the legislative framework. A paradigm shift has been triggered with the onset of the various Bills such as Finance Act (2011), Income Tax Act and Finance Bill (2012- includes the General Anti Avoidance Rules, see details here), Prevention of Money Laundering (Amendment) Act 2011, Benami Transaction (Prohibition) Bill 2011, Public Procurement Bill 2012, Prevention of Bribery of Foreign Public Officials Bill 2011 and the Lokpal and Lokayukta Bill 2011. With India dropping 11 places to the 95th position globally in Transparency International’s Corruption Index (2011), dialogue on the implementation and future of these Bills in tackling the twin problems of deep rooted corruption and inefficiencies in the governance system is vital.

The involvement of high level officials, politicians, & well known business-houses in various large-scale scams present a serious concern when studying problems of low monitoring of institutions, rent-seeking, bribe taking and embezzlement of funds (an interesting outlook on the legal and illegal facets of corruption in the recent issue of EPW can be found here). The relationship between the private and public sector is important to note here. Reports from academia, policy institutions and news reports have uncovered the blatant usage of power for personal gain and the magnitude of distortions that occur at the government-business level. This dialogue has not only displayed the levels of dependency of businesses on government (and vice versa) but also revealed a routinization of this dependency across time. The report realises the negative effects of entities arising out of state-business links and comments on the need for corporate structuring:

“Corporate structuring is a legitimate means of bringing together factors of production in a way that will facilitate business and enterprise and help the economy. However, an artificial personality can also be created of a corporate entity to conceal the real beneficiaries. Opaque structuring through creation of multiple entities that own each other and the secrecy granted by certain jurisdictions facilitate such misuse”

To rectify this gap (between illegal activities and the role of the governance institutions in catching the culprits), the report strongly recommends:

a) Methods to bring back the money

1. A highly critiqued suggestion by the government was the bringing in of the Voluntary Disclosure Schemes for Tax Recovery, wherein ‘partial benefits in the form of immunity from prosecution will be made available in lieu of voluntary disclosure’[3] of assets.

2. Multilateral Convention on Mutual Administrative Assistance in Tax Matters– India ratified this convention early this year. It is primarily for assistance in tax collection from countries who are part of this convention.

3. Stolen Assets Recovery (StAR) : India is collaborating with the World Bank Group and the UNODC ( United Nations Office on Drugs and Crime) to end the existence of safe havens for corrupt funds.

b)Creation of effective systems within the governance structure

Besides giving the establishment of a Lokpal a big thumbs up, it also suggests the formulation of:

1. A Directorate of Criminal Investigation: To be set up within the Department of Revenue for the investigation, review of complains and prosecution of those implicated in illegal activities under direct tax laws.

2. Setting up fast-track courts: These will ensure that cases are tried in a time-bound manner.

3. Income Tax Overseas Units: To aid authorities across foreign shores in collecting taxes and keep a check on foreign investors investing in India.

4. Committee on Black Money: This was formed in May of 2011. It is currently being headed by the Chairman of the Central Board of Direct Taxes (more details here) and primarily suggests policy recommendations.

5. National Tax Tribunal: To be set up in immediate effect to deal with tax litigation cases.

6. Economic Offenses Court: Recommended for the High Courts to set up an exclusive court to deal with tax cases.

Some points to ponder about:

1. The report does not source any primary government studies on the subject. What are the quantifiable government’s records on black money? Why have they not been considered at all? The lack of details is my primary criticism of this report.

2. The report in the beginning states that there is a ‘Need for more research’. Why is there no emphasis on the government’s initiatives in this regard? Is there no ongoing research being conducted if it is truly seen to be a problem facing the nation?

2. What is the feasibility of the government in conducting a program in which providing incentives to those who voluntarily disclose their assets is the main objective (after already stashing their assets on foreign shores)?

4. There is an emerging need for national governments to work closely and comprehensively with banks and intelligence bodies overlooking tax haven locales-

The political dimension of money is definitely not a subtle one. It is evident from the report that the problem of black money and corruption requires an approach that is wide-ranging. This ‘White Paper’, with all the criticism’s it has received, is still a step in the right direction towards tackling the numerous problems associated with black money. It will be interesting to see to what extent the recommendations will be implemented and which ones succeed.

[1] White Paper on Black Money. http://pib.nic.in/archieve/others/2012/may/d2012052101.pdf. May 2012, Page 2

[2] It was mentioned, however, that these estimates were mostly an underestimate. White Paper on Black Money. http://pib.nic.in/archieve/others/2012/may/d2012052101.pdf. May 2012,

[3] White Paper on Black Money. http://pib.nic.in/archieve/others/2012/may/d2012052101.pdf. May 2012. Page 67