Of Backwardness and Special Status- Part 1

23 October 2013

The last few months has seen a clamour from states including Odisha and Bihar for receiving “Special Category Status” (SCS). Meanwhile, last week a panel headed by Raghuram Rajan released a new index of “underdevelopment” to determine central fiscal assistance to states. The index ranked Odisha and Bihar amongst the least developed states. . What do these criteria mean? What are the benefits of SCS? How is the new underdevelopment index different? This blog attempts to lay out the changing nature of centre – state finances through an analysis of both SCS and the new underdevelopment index. The blog is divided into 2 parts. The first part attempts to detail the definition of SCS in the context of the changing nature of centre-state finances. The second part discusses the new underdevelopment index for addressing development needs.

Background

The concept of SCS was first introduced in 1969 when the Fifth Finance Commission sought to provide historically and geographically disadvantaged states greater fiscal assistance. The idea being – some states are unable to mobilize adequate resources for development and thus require special attention. The decision to grant SCS rests with the National Development Council[1] an advisory body to the Planning Commission and is based on a certain set of indicators. These are: hilly and difficult terrain, low population density, high proportion of tribal population, strategic location along borders with neighbouring countries, economic and infrastructure backwardness and non-viable nature of state finances. Starting with only three states in 1969- Assam, Nagaland and Jammu there are currently 11 SCS including all eight north-eastern states, Himachal Pradesh, Jammu and Kashmir and Uttarakhand (the last to be added in 2001).

Before getting into the benefits of the SCS it would be important to understand the nature of Centre-state financing.

Central State Financing

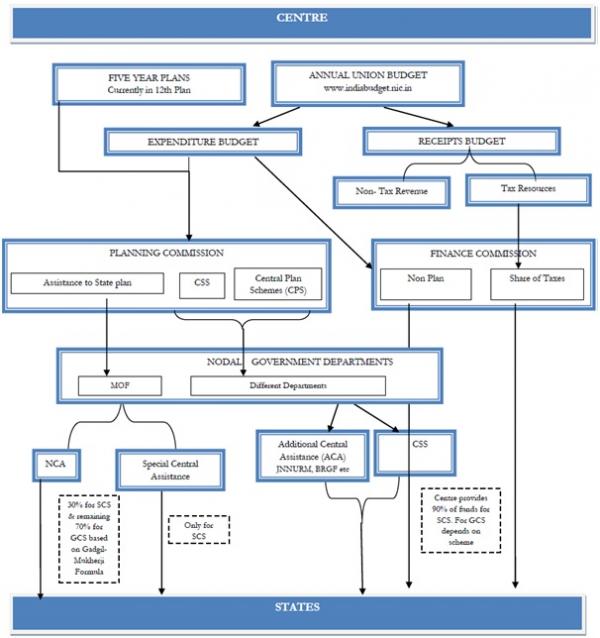

Transfer of funds from centre to states are determined by two main bodies:- the Finance commission and the Planning commission. (See graph below)

Finance Commission

The Finance commission is responsible for devolving central tax revenues to different states. The 13th FC set aside 32% of central tax revenue for states. In 2011-12, this amounted to Rs. 2.5 lakh crores making it the largest transfer (57%) to states. In addition, the FC recommends the transfer of non-plan grants and loans to states. These can be for state-specific needs such as disaster relief, building of roads and bridges, delivery of justice etc.

Planning Commission

Broadly, the Planning Commission transfers funds to states in two ways. These are:-

a) Central Assistance to State Plans which includes Normal Central Assistance (NCA) or unconditional block grants to States to finance their own plans; Additional Central Assistance (ACA), usually in the form of assistance for schemes such as Jawaharlal Nehru National Urban Renewal Mission (JNNURM), National Social Assistance Programme (NSAP), Backward Regions Grant Fund (BRGF) etc (Details on JNNURM and NSAP are available here insert hyperlink) and Special Assistance including grants for Border Areas, North Eastern Council, Bodoland Territorial Council etc

b) Grants through Central ministries in accordance with guidelines of various Centrally Sponsored Schemes and Central Plan Schemes such as Sarva Shiksha Abhiyan (SSA), National Rural Health Mission (NRHM), Indira Awas Yojana (IAY), Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) etc.

Benefits of SCS

The main benefit for SCS comes from grants determined by the Planning Commission.

- First, out of the total funds for NCA (excluding externally aided programs), 30 percent of the funds are blocked for SCS. The remaining 70 percent are given to GCS on the basis of the Gadgil-Mukherji Formula[2]. Earlier, the type of funding was very different with SCS receiving 90% grants and 10% loans whilst GCS receiving only 30% grants. However, following the 12th FC recommendation that centre only gives loans, the 90:10 formula for SCS has been restricted to only CSS.

- Second, SCS receive specific assistance addressing features like hill areas, tribal sub-plans and border areas as well as concessions in excise, custom duties and tax breaks.

- Finally, with respect to Centrally Sponsored Schemes, if there is a sharing ratio between Centre and states, for SCS, the Centre provides 90 percent of the funds. For example, for SSA while GCS have a sharing ratio of 65:35, for SCS it would be 90:10.

Changing Nature of Centre-State Financing

Over time, there has been decreasing relevance of NCA funds in terms of the total resources transferred to states from the centre.

First, while the number of states has increased from 3 to 11 between 1969 and now, the quota of 30 percent has remained the same. As a result over time the proportion of funds received by each SCS has gone down.

The NDC decided in 1969 that Central Assistance to States for their plans should be unconditional block grants to enable them to plan in accordance with needs and scheme based support should be restricted to 1/6th of the untied assistance. Despite this, NCA transfers as a proportion of total plan transfers has fallen from 35 percent in the Ninth Five Year Plan to only 10 percent in the Eleventh Five Year Plan. In 2011-12, NCA constituted only 8.2 percent of total plan transfers. In fact, as a proportion of total resources transferred to states, it was a mere 3.8 percent. [3]

In contrast, recent years has seen a dramatic increase in the share of funds transferred through CSS. As a proportion of the total plan transfers, share of CSS has risen from 25 percent during the 9th Five Year Plan to over 50 percent during the 11th Five Year Plan.[4] As mentioned earlier, a large portion of the ACA too is tied to schemes such as JNNURM, BRGF, NSAP etc.

Add to that the fact that a large proportion of funds for CSS are transferred directly to state implementing societies thereby bypassing the state treasury. In 2007-08, Rs. 53014 crores were transferred directly to implementing societies. In 2013-14, this has tripled to Rs. 164195 crores.[5]

Emphasis on a new approach for addressing backwardness

While the SCS has been important in addressing historical disadvantages of many states, the above discussion highlights that the nature of centre-state financing has moved from the traditional approach of providing unconditional grants to a more schematic based approach in addressing fiscal imbalances and backwardness. In such a context, and given that the SCS is limited by its specific criteria[6], backward states such as Bihar, Odisha and Jharkhand have had to rely on additional resources from the centre through the scheme route.[7] These however tend to be based partially on states bargaining powers, as well as, the specific guidelines for each CSS. For instance under NRHM, a set of High Focus states receive the largest share of resources. Under SSA, there is no such specific criteria and allocation is based on a combination of requirements based on plans, past performance as well as availability of funds. Given these changes, recent years has witnessed a growing debate on the need to address regional disparity through a fresh approach in transferring funds to states. In September 2013, an expert committee headed by Raghuram Rajan developed a new index for “underdevelopment”. While the underdevelopment index is not a replacement of the SCS, it attempts to develop a more holistic approach of underdevelopment taking into account socio-economic indicators to determine need and also performance. Part 2 of the blog will discuss the index in more detail.

[1] The NDC comprises the Prime Minister, Union Ministers, Chief Ministers and members of the Planning Commission.

[2] The formula gives weight to population (60%), per capita income (25%), fiscal performance (7.5%) and special problems (7.5%).

[3] Ministry of Finance (2013) – Report of the Commitee for Evolving A Composite Development Index of States

[4] Bhattacharjee, G (2013), “Special Category Status: Will it Actually Benefit Bihar”, Economic and Political Weekly, Vol XLVII No. 18, May 2013 and Expenditure Budget, Vol 1 available online at: www.indiabudget.nic.in

[5] www.indiabudget.nic.in

[6] An inter-ministry group in 2012 found that Bihar did not meet all the criteria for receiving the status.

[7] A cabinet committee recently approved Rs. 12,000 crores as special plan under the BRGF for Bihar