Decrease in Funds for MGNREGS Amidst Increasing Rural Unemployment

13 July 2022

The Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), India’s flagship programme on rural livelihoods, witnessed neither a mention in the Budget speech for FY 2022-23 nor an increase in the budget allocations despite a staggeringly high unemployment rate in the last two years. Meanwhile, unemployment is on the rise as the pandemic continues. Given the relevance of MGNREGS as a social safety net in rural India, the reduced allocation to the scheme may prove disadvantageous.

As economic opportunities plummeted due to the COVID-19 induced slowdown, the unemployment rate in India skyrocketed to 10.35 per cent in calendar year(CY) 2020 and 7.8 per cent in CY 2021, as compared to 4.5 per cent in CY 2017. Inevitably, many people were forced to look for alternative sources of income and flocked to access MGNREGS, which guarantees at least 100 days of wage employment in a Financial Year (FY) to every rural household that demands work.

Thereby, the work demanded under the scheme soared from 6.2 crore households in FY 2019-20 to 8.6 crore households in FY 2020-21 and 8.1 crore households in FY 2021-22. While employment provided has also increased, there exists significant unmet demand (the difference between employment demanded and provided) with 79.6 lakh households not getting work despite demanding it in FY 2021-22.

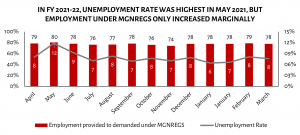

Using the unemployment data from the Centre for Monitoring Indian Economy (CMIE) for FY 2021-22, we see that peak unemployment was observed in May 2021, at 11.8 per cent. The increased employment provided from MGNREGS for the same period, in comparison, however, was minimal, rising from 79 per cent employment provided-to-demanded in April 2021 to 80 per cent employment provided-to-demanded in May 2021. Following that, employment provided by MGNREGS remained more or less stable at around 76 per cent, with a small dip witnessed in November 2021.

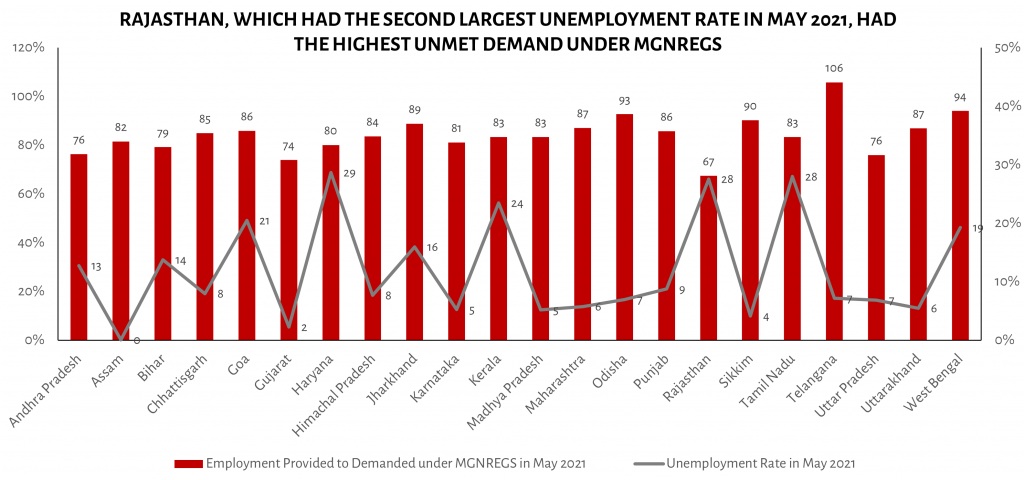

A state-wise analysis is also revealing.

Looking particularly at May 2021 (when the unemployment rate was the highest), Assam had a moderate proportion of employment provided to employment demanded under MGNREGS (82 per cent), given its unemployment rate was 0 per cent. On the other hand, Haryana’s unemployment rate was at 29 per cent, whereas the proportion of employment provided-to-demanded under MGNREGS was 80 per cent. Telangana had the highest employment provided-to-demanded at 106 per cent with a moderate unemployment rate of 7 per cent.

In contrast, Rajasthan, which saw a high unemployment rate of 28 per cent, had the smallest proportion of employment provided-to-demanded under MGNREGS at just 64 per cent.

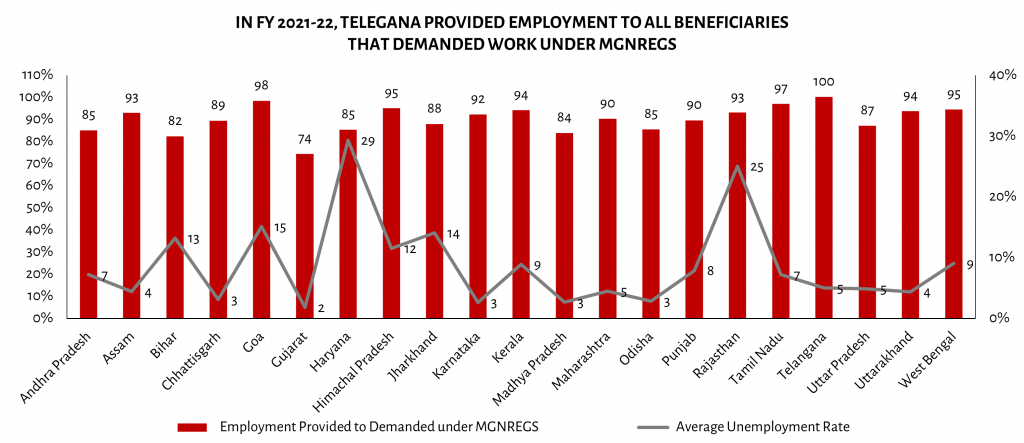

Looking at state-wise comparison of average employment provided under MGNREGS for FY 2021-22 to the average unemployment rate for the year, Haryana and Rajasthan showcased the highest unemployment rate at 29 per cent and 25 per cent, respectively. This trend extends on what was observed in May. In contrast, Meghalaya and Gujarat had the lowest unemployment rate at 2 per cent each. While Rajasthan managed to have a high proportion of work demand met by MGNREGS at 93 per cent, Haryana had significant unmet demand. Telangana, on the other hand, had the highest employment provided by MGNREGS, whereas Gujarat had the lowest employment provided-to-demanded under MGNREGS.

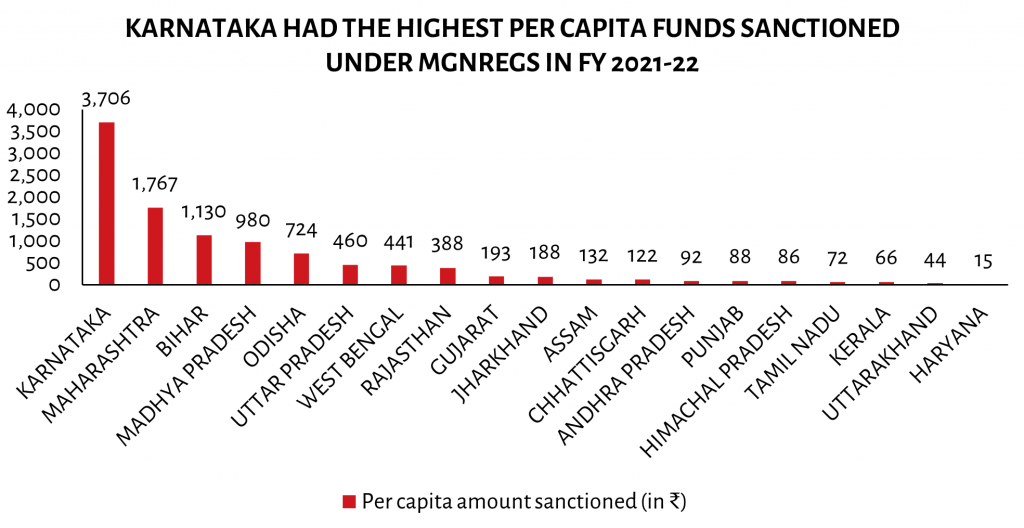

The trend of employment generated is greatly influenced by the amount of funds received by states under the scheme, and there is a huge variation in the amount sanctioned to each state. For instance, at the end of FY 2021-22, Karnataka and Maharashtra were sanctioned the most funds under the scheme at Rs. 13,88,429 lakh and Rs. 10,87,551 lakh respectively. Mizoram and Goa were sanctioned the least funds at Rs. 59,065 lakh and Rs. 10,505 lakh respectively.

Focusing on larger states, as categorised by the NITI Aayog, in per capita terms, Karnataka and Maharashtra were sanctioned the highest funds per capita under the scheme at Rs. 3,706 and Rs. 1,767 respectively. Given the high sanctioned funds, Karnataka also displayed a low average unemployment rate of 3 per cent and a high proportion of employment provided-to-demanded of 92 per cent. Similarly, Maharashtra had a low average unemployment rate of 5 per cent and a high proportion of employment provided-to-demanded of 90 per cent.

Haryana, on the other hand, was sanctioned the least amount of funds under MGNREGS at just Rs. 15 per capita. Haryana also reported a very high average unemployment rate of 29 per cent and a moderate proportion of employment provided-to-demanded under MGNREGS of 85 per cent.

Thus, low funds sanctioned in FY 2021-22 affected the state’s ability to provide employment under MGNREGS. Increased funds would allow better access to the scheme and decreased proportion of unmet demand.

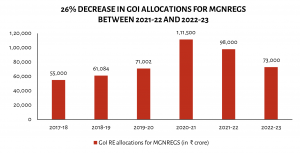

In this context, then, it was expected that the budget allocation for the scheme in FY 2022-23, would be cognizant of the significance of this social safety net. However, for the current FY, GoI allocated Rs. 73,000 crore to MGNREGS. This was the same as the BEs for FY 2021-22, but 26 per cent lower than the previous year’s REs.

Despite its limitations, the scheme has proven to be the most crucial combating force against the COVID-19 pandemic-induced unemployment. An increase in the scheme’s allocated budget would have allowed for better performance in the current financial year. Unfortunately, the reduction in the budget will only lead to a further increase in unmet demand under MGNREGS and low access to the world’s largest social security scheme.

Ria Kasliwal and Jenny Susan John are Research Associates at Accountability Initiative.

Also Read: In a Glance: MGNREGS Wages