Rants of a Public Finance Junkie

17 February 2012

For the past few months, my colleague and I had been holed up at the National Institute of Public Finance and Policy (NIPFP), trying to “uncover” the wonderful world of state budgets. Our task appeared to be simple – we wanted to categorise the elementary education budget for various states into more accessible and functional categories, thereby enabling us to estimate the “cost” of various inputs in delivering elementary education. This would further allow us to compare differing state priorities on the basis of the “type” of allocations/ expenditures. So for instance, since we were working on education, the categories consisted of:-

- School Infrastructure

- Teacher salaries,

- Teacher inputs (such as training, materials etc),

- Entitlements for children such as uniforms, textbooks etc,

- Mainstreaming of children (out of school etc),

- “Quality” related inputs and,

- Administration.

Did I say simple? Umm… not so much. Let me explain.

The existing system of classification divides the Consolidated Fund of India (namely, the fund from which all expenditures of the Government are incurred into Revenue and Capital Sections (for more details on revenue and capital expenditure please see here) and requires that all expenditures be categorized into these two broad divisions at the highest level. At the operational level, all allocations and expenditures are classified using a 6 tier hierarchical classification. These are:-

|

Classification |

Type of Classification |

|

Major Head |

Represents the major functions of the government |

|

Sub-Major Head |

Represents the sub-functions of the government |

|

Minor Head |

Refers to government programmes |

|

Sub-Head |

Schemes of the government |

|

Detailed Head |

Representing sub-schemes |

|

Object Head |

The economic “type” of expenditure |

Thus for example in education, if we wanted to know the amount of money being allocated for the Centrally Sponsored Scheme (CSS) providing grants in aid to SCERT for teacher training institutions, we would have to drill down from:-

2202- General Education (Major Head)

01 – Elementary Education (Sub-Major Head)

001- Teacher Training (Minor Head)

85- Teacher Training Institution

99- Grants in aid to SCERT

31- Grants in aid to SCERT (CSS)

(for more details on Minor Heads and Major Heads, please see here)

OK, now having detailed the task at hand, let’s get to the problems (this is going to be a long list). So reader patience is advised.

1) Logistical

One of the first (though probably the least important given the list!) is the sheer logistics of looking at state budgets. Many states do not have their budgets online, or if they do the links don’t always work, and past years’ budgets are unavailable. Moreover, often while the overall budget is available, the “detailed demand for grants” (necessary for disaggregation) is not. The task thus requires access to a library such as NIPFP and a LOT of manual data entry! Moreover, the sheer volume of budgets (some states have 9 volumes) results in a lot of heavy lifting! Further, some budgets are only in Hindi, which makes it difficult for those whose vernacular is not Hindi to access such documents

2) Lack of Uniform Accounting systems

a. Differing Budget Heads:

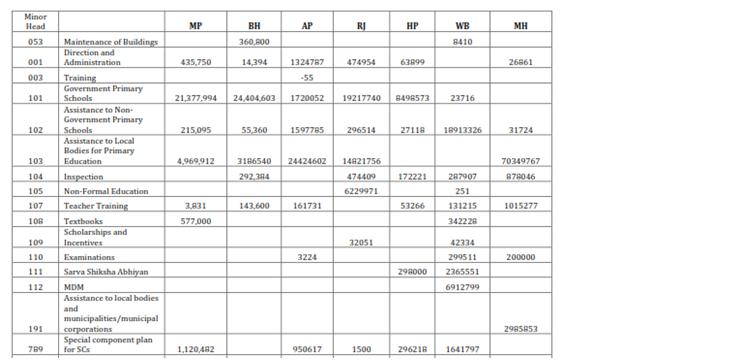

Under the current system of classification, functions not only repeat themselves under revenue and capital sections but more importantly, there is no uniformity of classification in terms of budget heads across states. A look at the table below containing collated information for 2008-09 indicates the basic problem. For each state, allocations are booked under different budget heads. To give an example, while Sarva Shiksha Abhiyan should technically be a sub-minor head (as it is a scheme), it is sometimes included as a minor head (a government programme). As a result, while Himachal Pradesh and West Bengal give SSA separately as a minor head (111), for other states it comes as a sub-minor head under government primary schools (101). Similarly, for some states such as Madhya Pradesh and West Bengal, textbooks have been mentioned separately, it does not mean that other states do not provide textbooks. The truth is that in other states it is booked under a detailed head.

Source: Compiled from the Comptroller and Auditor General, State Finance Reports. Numbers are provisional.

b. Functional Categories not always “functional”

As the recently released Rangarajan Committee Report (see here) – (a must read for those interested in public finance) aptly recognises, “functional heads should be really functional” – though that is often not the case. For instance, a major head like 2552 (North Eastern Areas), does not really signify any “function” of the government and even expenditure on education in North Eastern Areas is shown under this head. As such, as the report highlights “This is a geographical attribute camouflaged as functional attribute”, increasing the difficulty in classifying budgets.

c. Lack of Uniform Measurement units

Related to the lack of uniform budget heads is the lack of uniform units of measurement. While some states report in lakhs, others in crores, others in thousands, some states such as West Bengal report actual numbers. Collating these in itself becomes a cumbersome process and requires us to have our 0’s in order!

d. Decoding some of the Budget Heads

A further complication caused by the lack of uniform budget heads was the fact that often the detailed object heads were missing, resulting significant problems with decoding the budget heads. For instance, a budget head such as “Assistance to local bodies” consists broadly of monies provided to Gram Panchayats etc for the delivery of education. Within it, however there would be components of salaries, administrative expenditure, maintenance works, inspection, and even actual schools built by the Zilla Parishad.

3) Dealing with Multiple Departments or Budget heads other than 2202.01

While some states, such as Karnataka and Rajasthan classify their budgets only according to budget heads, for most states it is done department wise. An example below:

One would imagine that education would be under the Department of Education. Unfortunately, that is not necessarily true. State governments also draw funds from the Tribal Welfare Department, Social Welfare and Justice Department, the Planning Department and Public Works Department amongst others. While some states book grants from Tribal Department and Social Welfare Department within 2202.01 as Tribal Area Sub-Plan and Special Component Plan for Scheduled Castes, others would require going through each and every department within the state budget. For instance, a state such as Chhattisgarh had the education budget head in 14 different departments , while in Maharashtra, the planning department gives elementary education for each district (35 of them) separately!

In other cases, within the department of education itself, other budget heads such as 2059 (public works), 2225 (welfare of SCs), 2235(welfare of STs etc) are included further complicating the collating system.

Given the current push for accountability and transparency, it is surprising that detailed state budgets continue to be inaccessible to most. It is no wonder that for many (including me!), understanding and more importantly analyzing them remains an extremely daunting task. While, initiatives such as the the RBI’s annual State Finances –A Study of Budgets by the RBI (link here) are commendable, they still do not give the disaggregation required for us public finance junkies !

I am happy to report that we managed to task at hand, at least for the 7 states we were studying (For a look at the results, please look here), and since we are gluttons for punishment, we hope soon to do similar classifications for more states and even more sectors. Wish us luck (and sanity)!