Watching the Red Tape

16 November 2010

In June 2010, Political and Economic Risk Consultancy, a Hong Kong based group announced the result of a survey of 1300 business executives undertaken in 12 Asian countries. The result of the survey – amongst the countries polled, India has the greatest amount of red tape. In fact, a BBC report goes so far as to use the word “stifling” to describe the Indian bureaucracy and that “working with civil servants was a slow and painful process”. So, can the civil service impede growth and if so, how?

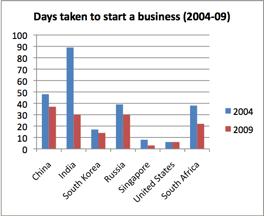

For starters, there is said to be a strong link between bureaucracy and corruption, whereby selfish civil servants are more interested in maximising gain from their individual position rather than in overall social welfare. In addition an over-officious bureaucracy can cause a nightmare of doldrums and delays and regulatory hassles hindering normal business activity. For instance, as per World Bank statistics, it takes 30 days to start a business in India after obtaining clearance from all concerned ministries while Singapore or the US takes 3 and 6 days respectively. While regulatory hassles have undoubtedly eased since 2004, scope for further improvement seems limited unless some radical measures are undertaken. A streamlining of the bureaucracy is essential not only in the interest of the economy but other aspects too, for instance, construction of strategic border roads in the Himalayas near the India-China boundary was languishing for two years, waiting for environmental clearance while China merrily continued its massive infrastructure projects.

[Source: World Development Indicators, World Bank 2010]

Now, it is not a blanket truth that corruption among the bureaucracy per se leads to inefficiency and disincentives to private sector investment. What is probably more important in this context is the frequency with which bribes have to be paid to avoid regulation. A one step process may actually be efficient if the regulator or the recipient of the bribe accelerates the payer towards his destination, However when we have multiple regulators with common jurisdiction and concomitantly multiple demands at each stage, we have a problem.

But, can we put specific numbers to the loss in growth? Cagla Okten did just that in a study of 99 countries over the years 1981-92. Defining bureaucracy as “multiple government units with common regulatory jurisdiction over firms” and using the number of government ministries as a measure of its size, her concern is clearly the effect of multiple regulation on firm investment and GDP. She considers the relationship between government and firms through a modified version of a Principal-Agent model. There are multiple principals (government ministries) here which want an agent (firm) to achieve some social objective. I will not go into the mathematics here, but her conclusion is that when government ministries do not cooperate, the amount of tax a firm has to pay is higher than the efficient amount, and increases with the number of regulators. If this is true when assuming that the bureaucracy is acting benevolently, one can only imagine the efficiency loss when there are multiple ministries acting out of self-interest.

Okten also conducts an empirical analysis wherein she tests the hypothesis whether the investment level of a firm is a decreasing function of the number of ministries. After taking several variables, including those related to initial GDP levels, education, government size and political stability into account, she concludes that total investment (as a share of GDP) has a negative and significant relationship with the number of ministries. In fact, an increase in the number of regulators by one unit is associated with a decline in total investment by 0.2% to 0.6% of GDP for different specifications of the investment function. Going one step further, Okten also shows a significant and negative impact of the number of ministries on the rate of growth of per capita GDP.

A natural question that follows is what factors determine the size of the bureaucracy or civil service. Rajaraman & Saha study this issue in a 2008 paper. They define the number of civil servants to include not only the glorified top tier officers in the administrative or civil services but also the middle and lower rungs of government employees. The study indicates that population and income levels as measured by GSDP have a bearing on the number of civil servants, with the former showing a stronger relationship. They also observe a “scale effect” which suggests that there may be more cost efficient in having larger states vis-à-vis multiple smaller units. This proposition makes sense – if we think that a government would require a minimum number of employees to set its wheels in motion, there should be a fixed component to the number of civil servants along with a variable component that depends on population or income levels (or both).

Returning to the original question of whether the civil service can impede growth, we see that a bloated bureaucracy, where multiple units have common jurisdiction can be a decided hurdle to economic growth by giving rise to a framework where individual accountability gets blurred. Kaushik Basu echoes a similar sentiment when he claims that a more efficient decision-making system in government through reforming the bureaucracy can help India reach double digit growth rates. Till now, the civil service has strenuously resisted attempts to reform itself, but it is now time to shake it out of the rut it finds itself in, for who will watch the watchmen if not the watchmen themselves.

(Too dynamic for the civil service?)

Anirvan Chowdhury is a Research Associate at the Accountability Initiative.