Let’s not get lost in the numbers: Highlights of Pradhan Mantri Jan Dhan Yojana (PMJDY)

15 October 2014

On the 28th of August, with much fanfare, the government launched the Pradhan Mantri Jan DhanYojana (PMJDY) – a national mission on financial inclusion. The inaugural day saw a record 1.5 crore bank accounts opened across the country, possibly the largest number seen in a single day anywhere in the world!

While the scheme hopes to cover 7.5 crore people by January 26th 2015, the sheer rush to meet numbers has resulted in some degree of confusion and chaos. This blog attempts to highlight the main components of the scheme and signal some challenges which should be kept in mind going forward.

The need for greater financial inclusion in India is well recognised. According to Census 2011, out of 24.67 crore households in the country, only 14.28 crore (58.7%) had access to banking services. Similar data from the World Bank suggests that only 35% of people had an account in a formal institution; only 8% had borrowed from a formal financial institution in the last 12 months, only 12% saved at a financial institution in the past year and only 8% had a debit card or had used the account to receive wages.[1]

Consequently, this is not the first time financial inclusion has received importance in policy documents. The UPA government’s Swabhimaan campaign launched in February 2011 had focused too on bringing the deprived section of the society into a banking network by providing banking facilities to habitations with a population above 2000 persons. Further, the RBI has also initiated a number of policy directions for greater financial inclusion (see Table 1).

Table 1: Some key RBI Guidelines[2]

| Year | Policy |

| 2006 | Banks were allowed to enlist non-profit Bank Mitr (Business Correspondent (BC)s) as agents for delivery of financial services to act as “last mile infrastructure” by providing basic banking services such as opening bank account, cash deposits, cash withdrawals, transfer of funds etc |

| 2008 | BCs should be located not more than 15 km from the nearest bank branch to ensure supervision

RBI issued guidelines or mobile banking and amended the same in December 2009 to ease various security norms and transaction limits |

| 2009 | Individual for profits were allowed to participate as BCs including gas stations, kirana stores etc. BCs were allowed to operate up to 30km from nearest bank branches |

| 2010 | Initial agreement between TRAI and RBI regarding rolling out of mobile banking

All companies listed under the Companies Act (1956) were allowed to act as BCs with the exception of non-bank financial services. |

| 2011 | RBI issued guidelines for opening Aadhaar Enabled Bank Accounts to facilitate routing of MGNREGA wages and other social benefits in to the accounts |

| 2012 | RBI permitted Aadhaar as proof of identity and address for opening bank accounts

GOI introduced Sub Service Area (SSA) approach for opening of banking outlet and Direct Benefit Transfer (DBT) Aadhaar Payment Bridge System (APBS) was introduced for centralised credit of DBTs Guidelines for DBT issued by GOI |

| 2013 | RBI permitted use of e-KYC for ease of account opening |

| 2014 | RBI issued guidelines for scaling up BC model |

Building on these policy guidelines, in 2014, the new government launched the PMJDY. The scheme comprises 6 key pillars, with the first 3 given a push in the first year of the programme. These are:

a) Universal Access to Banking Facilities by August 2015 done through the Sub-Service Area (SSA) approach by which each habitation has access to a banking facility within 5 kilometres;

b) Opening zero balance bank accounts with RuPay debit card, a one-time accidental insurance cover of Rs. 1 lakh and a facility of an overdraft or loan after satisfactory operation/credit history of 6 months and an additional Rs. 30,000 life insurance for those who opened the account before January 26, 2015

c) Financial Literacy Programme for ensuring greater awareness and effective use by the beneficiaries

d) A Credit Guarantee Fund to cover defaults in overdraft accounts

e) Provision for Micro-Insurance for all willing and eligible persons and

f) An Unorganised Sector Pension Scheme – similar to the Swavalamban scheme

So what’s so different about this scheme? In 3 words: scale, speed and शोर(for lack of a better word for advertisement and publicity). Let’s go over them one by one.

Scale: Unlike the previous Swabhimaan scheme of the UPA which focused on villages, the PMJDY focuses on households, thereby covering both urban and rural areas. Moreover, unlike previous efforts, the PMJDY’s design is focused not just on bank accounts, but also on other products that provide incentives to people to open accounts sooner rather than later – specifically, the 1 lakh insurance cover and Rs. 5,000 overdraft facility. The scheme also envisages expanding the banking and ATM number, as well as, the remuneration and coverage of Business Correspondents or Bank Mitra’s.

Speed: The scheme identifies clearly set monitorable targets for setting up bank accounts. Consequently, as on October 7, 2014 over 5.52 crore accounts have been opened and a total of Rs. 4,268 crores deposited.[3]

शोर: A significant improvement is the publicity it has generated about financial inclusion amongst low-income citizens and the efforts that have been made towards financial literacy. (An example of an animated booklet is available here). The scheme also talks about creating local monitoring committees and a web portal to monitor its implementation at the national level.

However, ironically, while these are some of the key strengths of the PMJDY, too much focus on speed and numbers without adequate attention on implementation architecture has the danger of being the schemes key weakness as well.

Let me elaborate.

First, in order to reach the universal access, the scheme contained a number of incentives to reach “maximum beneficiary in minimum time”. However, while the main idea was to reach those who do not have access to a bank account, initial confusion about the account benefits – particularly the in-built 1 lakh insurance benefit led to a wide rush for existing account holders to open new accounts. Second, the sheer rush to meet “targets” has resulted in a number of duplicate accounts. According to the RBI executive director, people can open accounts using different identity documents like PAN Cards and Aadhaar in the lure of getting the accidental insurance cover.[4] Recognising this challenge, GOI has now tried to enlist KPMG to undertake verification – but that is happening post-facto.[5]

Further, bank accounts are being opened without the adequate facilities and infrastructure in place. For instance, many people are yet to receive their RuPayDebit cards and key aspects of implementation are still being worked out. For first time bank users, “bad experiences”can result in mistrust and people staying away from the banking facilities.

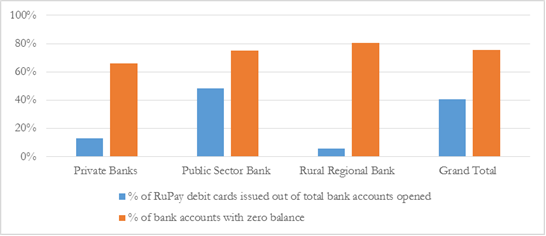

Second, the efficacy of the scheme lies in its usage. Past studies[6] have shown a large number of accounts lie dormant with zero balance. While it is too early to judge the scheme, the Government’s own data suggests that overall 76% of the newly opened banks have 0 balance. While the government hopes to link DBTs to these bank accounts (as was the idea even under UPA), this is dependent on adequate AADHAAR seeding and resolving other infrastructural, targeting and technical glitches. Key questions such as what constitutes “good use” for receiving overdraft and details on the insurance policies are still being worked out. It will be imperative to focus on usage if we are to ensure actual financial inclusion and economic viability of the scheme as well.

Graph 1: Progress of PMJDY till October 2014[7]

Finally, there is the more fundamental question of last mile connectivity. While PMJDY aims to hire an additional 50,000 BCs and increase their remuneration to Rs. 5,000, past studies suggest that there are problems with the BC model itself. In fact, according to a survey conducted by the RBI College for Agriculture Banking and the Consultative Group to Assist the Poor (CGAP) which tried to contact 2,358 agents across 15 large states in the period between September and November 2013, only 53 per cent could be reached and the remaining 47 per cent were untraceable! [8] It is unclear how the scheme will address these issues.

Time will tell if the JDY is able to learn from past experiences and ensure comprehensive financial inclusion. Till then though, one can only hope that one doesn’t get lost in just achieving the numbers.

For more details on PMJDY see: http://financialservices.gov.in/Banking/PMJDY%20BROCHURE%20Eng.pdf

FAQ is available here: https://www.sbi.co.in/portal/web/customer-care/-faq-pradhan-mantri-jan-dhan-yojana-pmjdy

[1]http://datatopics.worldbank.org/financialinclusion/country/india

[2] Department of Financial Services, Ministry of Finance, Government of India, PMJDY Mission Document http://financialservices.gov.in/Banking/PMJDY%20BROCHURE%20Eng.pdf

[3]http://financialservices.gov.in/banking/30sep2014/Accountsopened08oct2014.pdf

[4]http://www.thehindu.com/business/banks-to-be-careful-about-jan-dhan-yojana-rbi/article6427152.ece

[5]http://www.thehindubusinessline.com/industry-and-economy/banking/jan-dhan-yojana-kpmg-to-validate-number-of-accounts-opened-by-banks/article6386477.ece

[6]Microsave (2011), http://www.microsave.net/files/pdf/No_Thrills_Dormancy_in_NFA_Accounts.pdf and CMF, IFMR (2008) http://www.ifmrlead.org/cmf/wp-content/uploads/attachments/csy/1299/28_NoFrills_Cuddalore.pdf

[7] http://financialservices.gov.in/banking/30sep2014/Accountsopened08oct2014.pdf

[8]http://indianexpress.com/article/business/banking-and-finance/rbi-survey-finds-47-of-banking-agents-untraceable/