Rationalisation of Centrally Sponsored Schemes: Divergence between the 15th Finance Commission and the Union Government

8 July 2021

Centrally Sponsored Schemes (CSSs) are a critical component of public policy leveraged by the Union government to ensure a minimum welfare standard for all citizens. These have grown to 131 schemes over the years, accompanied by a rise in the quantum of funds allocated by the Union government. But there are concerns that the schemes limit the fiscal space available to states as they too have to contribute funds. This blog discusses how, despite the recommendations of successive Finance Commissions, recent measures to modify such schemes have not focussed on bringing down the states’ burden.

Essentially, scheme rationalisation is aimed at efficiently utilising limited budgetary resources available with the Union and state governments. Several Finance Commissions have intended to address the proliferation of CSSs, with the latest – the 15th Finance Commission – making substantial recommendations on rationalising the schemes.

Why Have There Been Demands for Rationalisation?

CSSs work on the principle of matching contributions between the Union and state governments. Over the years, state governments have insisted on rationalising CSSs as this would free up their limited funds.

The release of funds under CSSs are not formula-based, as is the case with tax devolution and Finance Commission grants. Instead, the funds are released if states meet certain conditions.

Additionally, CSSs aim at achieving a minimum welfare standard across the country (among other, more specific objectives), and they often do not factor in state-specific needs and contexts.

A look at scheme rationalisation attempts in recent years can also be helpful. The 13th Finance Commission held the view that the number of CSSs should be reduced since states are required to contribute to the CSS pool of funds as well, straining their overall fiscal resources. Instead, the Commission recommended greater significance to formula-based Plan transfers. [1]

The 14th Finance Commission too recommended revising the institutional mechanism for transferring funds from the Union to the states through CSSs to reduce the Union government’s discretion and foster cooperative federalism. [2]

Subsequently, to rationalise CSSs, a Sub-Group of Chief Ministers was constituted in 2015. A reshaping of CSSs into 28 Umbrella schemes was carried out by them — with six ‘Core of the Core’, 20 ‘Core’ and two ‘Optional’ schemes. This was done in order to enhance the impact of the CSSs, maintain their budget allocation, and grant states flexibility on scheme implementation. [3]

The 15th Finance Commission has called for discontinuing schemes that are small or no longer necessary, and instead putting in place a minimum budget threshold allocation for a CSS (guidelines on the threshold are yet to be issued). Where the budget allocation falls below the threshold, the concerned department will have to specify the rationale for continuing the scheme. This is because, at present, there are many sub-schemes with relatively small budget allocations, leading to limited efficacy and impact.

Rationalisation versus Restructuring

The Ministry of Finance has identified a total of 131 CSSs that are currently in place (comprising several ‘Umbrella’ schemes and, within those, numerous sub-schemes). The Union Budget for FY 2020-21 indicates that, out of 30 Umbrella schemes, 15 schemes account for 90 per cent of the total budgetary allocation for CSSs.

In response to the 15th Finance Commission’s recommendations, Expenditure Secretary T. V. Somanathan expressed the intention of the Union government to bring down the number of CSSs in FY 2022 by one-third. [4] However, media reports suggest that the government may not curtail the overall budget for CSSs — instead, funds may be reallocated to schemes that remain operational. [5]

One way to understand the impact of the expected policy decision is through the distinction between scheme ‘rationalisation’ and ‘restructuring’ as made by Bibek Debroy, Chairman of the Prime Minister’s Economic Council. He argues that the Union government has usually resorted to the latter. In his view, rationalisation would provide grounds for the existence of schemes, resulting in continuation of pertinent schemes and eliminating extraneous ones. It would, therefore, go several steps further than reorganising existing schemes. [6]

The allocation under CSSs has risen by nearly 13 per cent in the FY 2021-22 budget estimates (BEs) as compared with those of the previous financial year. At the same time, tax devolution in the FY 2021-22 BE was 15 per cent lower than the BE for the previous FY, showing a decline in untied fund transfers.

Recent examples of the streamlining of schemes also indicate that the emphasis has been on restructuring schemes, rather than reigning in the overall budget allocation for CSSs.

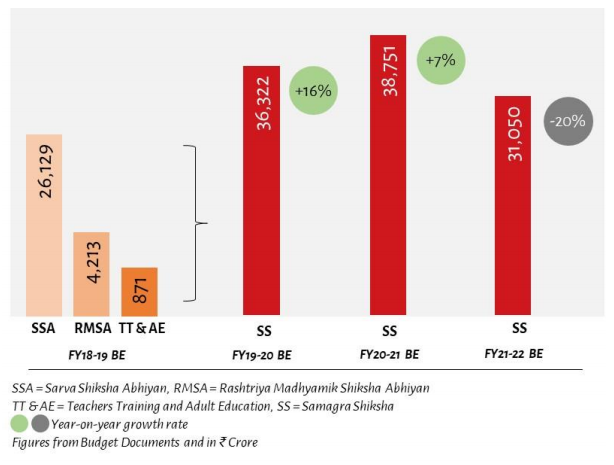

In April 2018, the Union government launched Samagra Shiksha under the Ministry of Education. In FY 2019-20, three erstwhile school education schemes were subsumed under Samagra Shiksha, namely: Sarva Shiksha Abhiyan (SSA), Rashtriya Madhyamik Shiksha Abhiyan (RMSA), and Teachers’ Training and Adult Education (TT & AE). Prior to the restructuring, the combined budget allocation for SSA, RMSA and TT & AE stood at ₹31,123 crores in FY 2018-19 BE.

Since the restructuring, the allocation for Samagra Shiksha increased in the subsequent years — to ₹36,322 crores in FY 2019-20 BE and ₹38,751 crores in FY 2020-21 BE. It declined for the first time only in FY 2021-22 – by 20 per cent – which is likely because of the COVID-19 pandemic. This suggests that focus was on combining schemes, and not to reduce the overall budget allocation.

Streamlining of the Flagship Schemes of the Ministry of Education

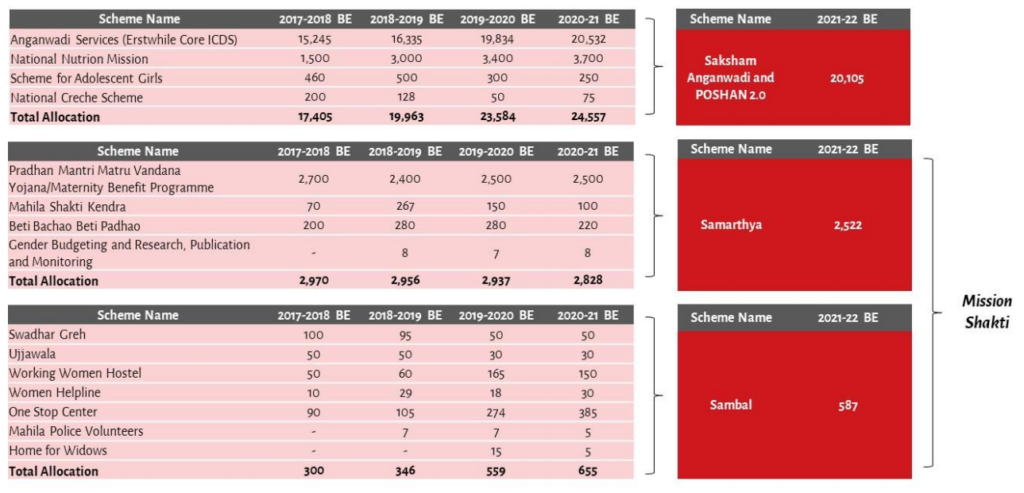

The government has also reshaped flagship schemes under the Ministry of Women and Child Development in the current budget. Two of the Core schemes (Umbrella ICDS, and Mission for Protection and Empowerment of Women) have been reconstituted into three new Core schemes (Saksham Anganwadi and Poshan 2.0, Mission VATSALYA, and Mission Shakti).

Streamlining of Flagship Schemes of the Ministry of Women and Child Development

Modifications to CSSs post the 14th Finance Commission recommendations led states to spend more on these schemes, raising the burden on their resources. The recent steps taken by the Union government too are better understood as a restructuring. Rationalisation of CSSs, on the other hand, can result in greater autonomy and fiscal space available to states.

Sharad and Udit are Senior Research Associates at the Accountability Initiative.

Also Read: The 15th Finance Commission and Changes in the Devolution Formula: Which States Stand to Lose?

[1] Formula-based transfers are distributed among states according to a normative framework. A formula is used to assess the needs and differences in the revenue capabilities of states. These are unconditional grants – thus, giving states the autonomy to allocate their budgets, and decide their own activities and expenditures.

[2] Report of the 14th Finance Commission. Retrieved from URL: <https://fincomindia.nic.in/writereaddata/html_en_files/oldcommission_html/fincom14/others/14thFCReport.pdf>

[3] Highlights and Major Recommendations: Sub-group of Chief Ministers – Centrally Sponsored Schemes. Retrieved from URL: <http://niti.gov.in/sites/default/files/2019-08/HIGHLIGHTS.pdf>

[4] Hindustan Times (2021). “15th Finance Commission Recommendations: Centrally funded plans face the axe”. Retrieved from URL: <https://www.hindustantimes.com/business/15th-finance-commission-recommendations-centrally-funded-plans-face-the-axe-101612317450012.html>

[5] The Print (2021). “‘Money is scarce’ — Modi govt set to axe about 40 schemes that ‘have lost relevance’”. Retrieved from URL: <https://theprint.in/india/governance/money-is-scarce-modi-govt-set-to-axe-about-40-schemes-that-have-lost-relevance/597926/>

[6] Financial Express (2019). “Restructuring of centrally sponsored schemes cannot be done without consultation with states”. Retrieved from URL: <https://www.financialexpress.com/opinion/centrally-sponsored-schemes-restructuring-cannot-be-done-without-consultation-with-states/1703515/>