The government plays a major role in Bihar’s school education system, with 78 per cent of the state’s total school-going children enrolled in government or government-aided schools [1]. Bihar has also recorded the largest government school enrolment in the country during the academic year 2019-20 [2]. However, the state has been struggling with funding challenges in the school education sector, which have been exacerbated by the pandemic. A dive into the state’s education budget throws up important insights.

Like other states in India, finances for school education [3] in Bihar are channelled through two major routes: funds coming from the state’s own budgetary resources, and those through Union government schemes. Union government schemes are of two types – Centrally Sponsored Schemes (CSSs) and Central Sector (CS) schemes.

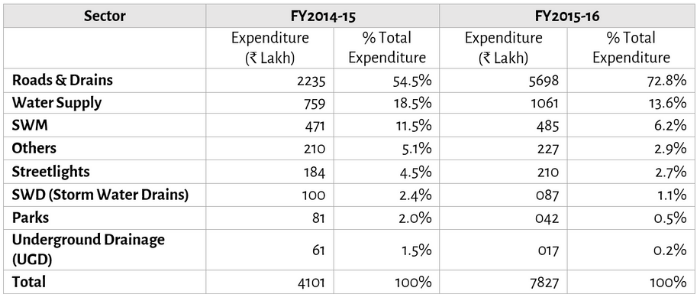

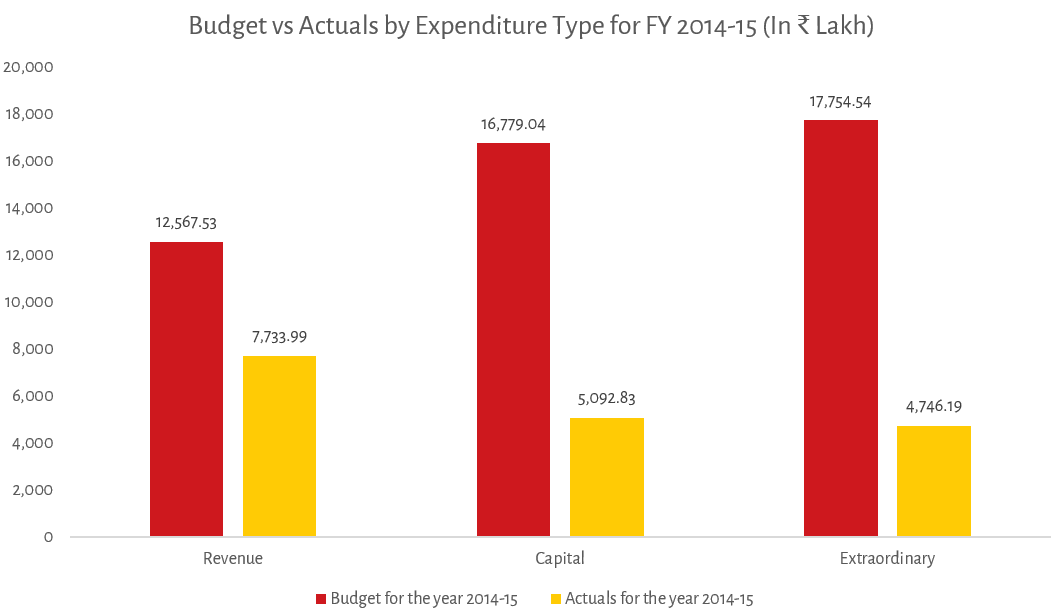

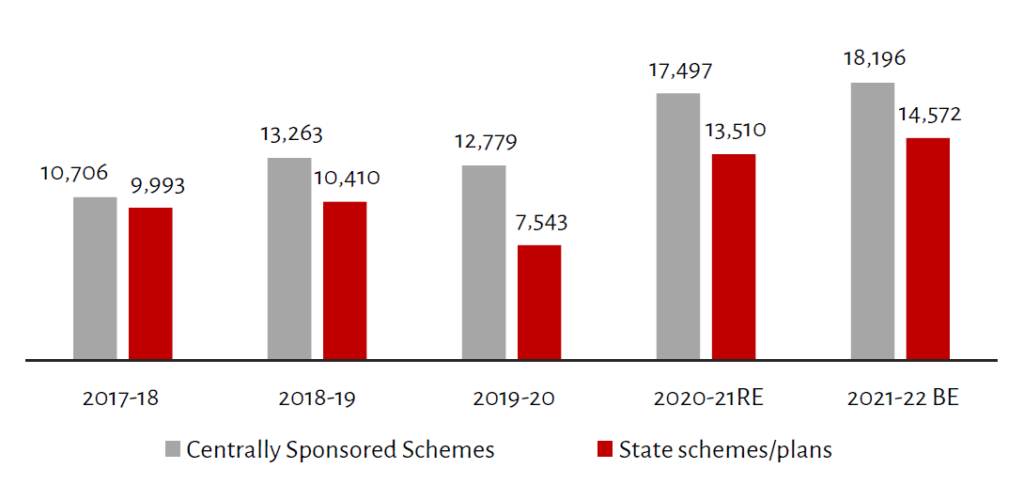

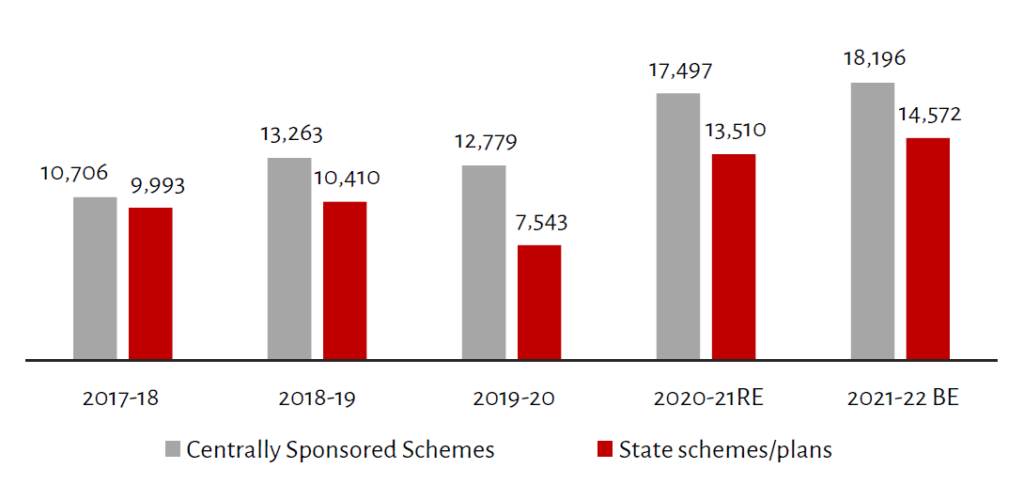

Analysis of the budget reveals that while CS schemes form a very small share of Bihar’s overall school education finances, its dependence on CSSs is considerably high, accounting for more than half of the state’s overall spending (refer to Figure 1). Of the total expenditure on school education in Bihar, spending through CSSs increased from 45 per cent in financial year (FY) 2014-15 to 63 per cent FY 2019-20.

Figure 1: Bihar’s public school education financing through CSSs vs. State schemes (₹ Crore)

Source: Collated from Bihar’s States Budget documents from FY 2019-20 to FY 2021-22.

Source: Collated from Bihar’s States Budget documents from FY 2019-20 to FY 2021-22.

Note: Figures from 2017-18 to 2019-20 are actual expenditures, those for 2020-21 are Revised Estimates (REs) and those for 2021-22 are Budget Estimates (BEs).

During the last four years [4], the Samagra Shiksha (which is the Union government’s largest CSS scheme to fund school education) and Mid-Day Meal (MDM) schemes contributed on average 82 per cent and 17 per cent respectively, to total CSS spending on school education in Bihar.

This year’s Union budget saw a cut in funds allocated for Samagra Shiksha. By scheme design, funds approved for a state need to be pooled by the Union government and the state in a 60 to 40 ratio. A drop in the Union government’s contribution in absolute terms, will automatically lead to a drop in the amount that can be contributed by the state. Thus, overall funds for school education coming through the CSS route are likely to be less this year for Bihar.

In fact, last year also (i.e. FY 2020-21) there was a decline of 14 per cent in the Samagra Shiksha budget approved for Bihar. The cut in Samagra Shiksha budget is likely to have a considerable impact on Bihar’s school education financing because of its relatively higher dependence on the CSSs. More importantly, the Bihar government budgeted for a 5 per cent increase in Samagra Shiksha’s allocation for FY 2021-22 as compared to last year’s allocations, which will now be difficult to finance.

The state’s own budgetary resources allocated for school education do not seem promising either. The current budget estimated an 8 per cent increase in allocations through state schemes compared to the previous year. However, in the past, finances for school education through CSSs have grown at a higher rate than the state’s own plans and schemes between FY 2014-15 and FY 2018-19.

For instance, while CSSs grew by 24 per cent between FY 2017-18 and FY 2018-19, the state’s own expenditures grew by only 4 per cent. In FY 2019-20, when there was a drop in Bihar’s education expenditure through both channels, the decline in expenditure through the state’s own schemes was higher (28 per cent) as compared to that through CSSs (4 per cent).

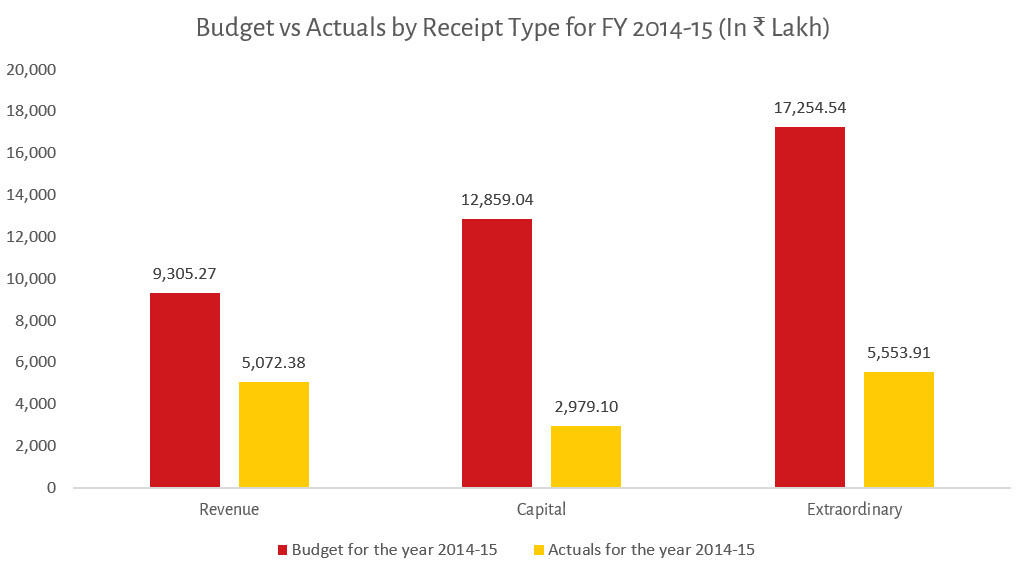

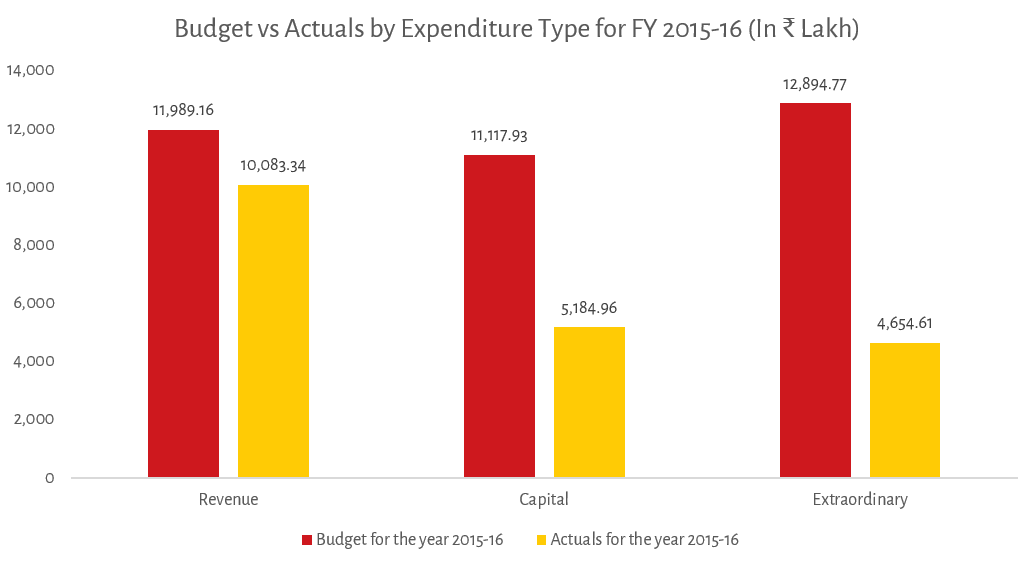

Budget allocations, as indicated by BEs [5] in a budget, do not mean much unless we look at actual expenditures. Considering all sources of funding, Bihar’s total budget allocations for school education saw a 9 per cent growth in FY 2020-21 as compared to the previous year’s BEs. However, the past trends indicate that there has been a huge gap between actual expenditures and allocations. Expenditures at the end of the year have been considerably lower than those allocated in the state budget at the beginning of that year.

A drop in the Union government’s contribution in absolute terms, will automatically lead to a drop in the amount that can be contributed by the state.

Moreover, this gap between allocations and expenditures has grown over the years. For Bihar’s education sector as a whole (known as General Education in budget terminology, and which includes school education, higher education, adult education, and language development), actual expenditures as a share of BEs declined from 95 per cent in FY 2017-18 to 84 per cent in FY 2018-19. This was 76 per cent in FY 2019-20.

Even the Revised Estimates [6] (REs) of the budget allocations – that are calculated mid of the year based on the expenditure pattern in the first six months – have been considerably higher than actual expenditures.

For instance, for school education, actual expenditure as a share of BE was only 69 per cent in FY 2019-20. Thus, it is highly likely that the state’s actual school education spending will be much lower than those reported in BEs for FY 2021-22.

To increase funding for school education in Bihar as envisaged in the state’s current budget, the finances coming from the state’s own schemes and plans, need to be stepped up. Even though Bihar’s recent budget has estimated an increase in allocations through state schemes, this might not be enough.

As discussed above, a slower pace of growth in expenditures through the state’s own schemes in the past indicate a lack of push by the state. Additionally, there is a pandemic-induced revenue crunch situation since FY 2020-21. Considering these, there is uncertainty on how much the state will be able to compensate for a cut in CSS funds such as the decline in the Samagra Shiksha budget in FY 2021-22.

Mridusmita is a Senior Researcher and Sharad is a Senior Research Associate at the Accountability Initiative.

Notes:

[1] UDISE Plus, 2019-20, Government of India. Available online at: https://udiseplus.gov.in/#/Publication

[2] UDISE Plus, 2019-20

[3] School education refers to formal education from pre-primary to higher-secondary grades.

[4] Between FY 2016-17 and FY 2019-20

[5] BEs or Budget Estimate refer to a preliminary assessment of funds projected to be available to any ministry or department for a financial year at the beginning of the year.

[6] Revised Estimates or REs are mid-year review of projected amounts of receipts and expenditure until the end of the financial year.

Source:

Source: