Unpacking the SSA Fund Flow Process: A case study of Rajasthan

28 March 2011

An essential question that arises while tracking expenditure in public programmes such as the Sarva Shiksha Abhiyan (SSA) is how is money transferred through the system? Specifically, what are the processes through which funds are transferred from the Centre to the unit of service delivery – in this case schools? This case study tries to unpack the fund transfer process by drawing on the experience of one state- Rajasthan, to map the various levels of bureaucratic hierarchy through which funds travel before finally reaching their destination – elementary schools.

The Dejure Planning and Fund Transfer Process- What the Guidelines say

Like all government programmes, the process of fund transfers in SSA begins with the formulation of a plan. The primary planning document under SSA is the Annual Work Plan and Budget (AWP&B) which consists of budgetary proposals for prioritized activities/interventions to be undertaken in the coming year, progress made and targets achieved in the previous financial year and the spill over activities proposed to be carried over to the current year. According to SSA guidelines, AWP&B’s are prepared in each state through a decentralized participatory planning exercise. Beginning at the habitation level, School Management Committees (consisting of representatives of parents and teachers) in consultation with community members are responsible for developing plans to reflect needs and priorities at the local level. Plans made at the habitation level are then compiled by the planning team at the block level (members of the planning team include, the Block Education Officer, Panchayati Raj representatives, and NGO representatives) into block level plans. These in turn are consolidated by the district core planning team (including the District Project Officer, and representatives from various departments such as Health, Public Works, Social Welfare and Women and Child Development) into a district level AWP&B. District AWP&B’s are then aggregated at the state level for the formulation of the State AWP&B.[2]

To ensure that the planning process is completed before the close of the financial year, SSA guidelines prescribe a time table for the preparation of the state AWP&B. In accordance with the calendar, the visioning exercise and planning of activities is required to be completed at the district level every year, by January 1st. The state level AWP&B’s are then prepared and submitted to the Project Approval Board (PAB) at the Ministry of Human Resources and Development by April.[3]

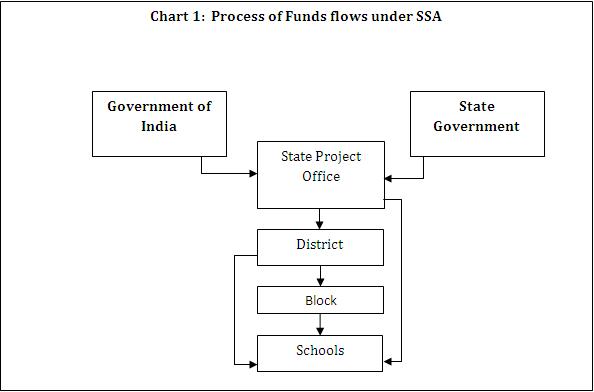

Once plans are approved by the PAB, money from the central government is released to the State Project Office (SPO), the body responsible for implementing SSA at the state level. Funds are received in two instalments, once in April and then again in September. Apart from the grants-in-aid given by the centre, 35% of the total SSA budget (including KGBV and NPEGEL) is funded by the state government. According to the norms the second instalment of grants from the central government is released only after the state has transferred its matching funds to the SPO. Thus by the end of the second quarter[4] of the financial year, a significant proportion of the total allocations should be disbursed to the states[5].

At the state level, the first instalment received from the Centre is first spent on teacher’s salary and administrative expenses. Overheads such as school grants are usually funded from the second instalment. School grants can be transferred funds in three ways. The state project office can either disburse funds through an electronic transfer to districts who release funds to the block. The block is then responsible for transferring monies to schools. Alternatively, funds can be transferred from the district directly to the school account. Increasingly, in many states with more sophisticated rural banking facilities, funds are transferred directly from the SPO to the school bank accounts. Funds when transferred from the district to the schools are treated as an advance (funds released from the district to the schools are initially classified as an advance). At the district level for reporting purposes such advances are treated as expenditures.[6] Advances are then adjusted upon receipt of utilization certificates/expenditure statements which are required to be submitted by schools within one month of the completion of the financial year[7]. Thus there are can be discrepancies between initial reportage of expenditure and final expenditures once the financial year closes.

The De-facto fund flow and planning process: The case of Rajasthan 2010-11

In Rajasthan the planning process for financial year 2010-11, began in the month of December 2009. Habitation and block level plans were prepared by the block office in consultation with the Cluster Resource Centre Facilitators (CRFC) who were responsible for assessing and compiling the school needs. The District AWP’s were subsequently prepared and submitted to the state in February, 2010. After the submission of the district level plans, the State began a process of compiling the state AWP&B which was later submitted to the PAB in May 2010. In all, there was a one month delay in the planning process.

Delays at the planning stage were followed by deferrals in the release of grants by the Centre. The first instalment which ought to have been transferred by April/May was received two months later in June on 07.06.10 owing, in part, to delays in the planning process. The second instalment was then transferred by the Centre on 22.07.10. The balance from the first instalment however was not transferred with the second instalment. Consequently, a third instalment was made by the centre to the SPO on 26.11.10. The state government in turn released its funds from the treasury to the SPO in three instalments beginning in April through till August 2010.

Table 1 below provides the details of the releases made by the Centre and the State up to December, 2010.[8]

Table 1: Fund transfer process in Rajasthan: April 2010 – December 2010

| Total Outlay Approved

(in Lakhs) |

GOI Share | State Share | ||||

| 279247.81 | Date of release | Date of receipt | Amount

(in Lakhs) |

Date of release | Date of receipt | Amount

(in Lakhs) |

| 25.05.10 | 07.06.2010 | 38000.00 | 22.04.10 | 29.04.10 | 21531.00 | |

| 07.07.10 | 22.07.2010 | 40933.00 | 25.05.10 | 28.05.10 | 9300.00 | |

| 26.11.2010 | 54299.00 | 07.07.10 | 07.07.10 | 21791.00 | ||

| 23.08.10 | 30.08.10 | 33091.00 | ||||

| 133232.00 | 85713.00 | |||||

According to the state level officials, funds were transferred to the district at the beginning of the second quarter (between august and September) of the financial year. The exact dates for fund transfer could not be ascertained. However, through an analysis of overall expenditures reported by districts at the end of third quarter (December, 2010) districts had received and reported expenditures on 78% of their total allocations of Rs 277286.52 Lakh. This is assuming that from the total funds received by the SPO on 26.11.10 which amounted to Rs 218945 lakhs, the total allocation for the SPO office was met (Rs 1961.290 Lakh) and the balance (Rs 216983.7 Lakh) was transferred to the districts[9]. During the same period, expenditure incurred at the district level was Rs 180198.565 Lakh, which accounted for 83% of the total funds transferred (Rs 216983.7 Lakhs)[10].

The total allocations for the three annual school grants amounted to Rs. 13212.515 lakh, 79% of the funds were reported spent by the end of third quarter.[11] According to the state expenditure statement dated 30.09.10 expenditure, 80% of the TLM grant, 41% of SMG grant and 82% of SDG grant had been spent.[12] By December, this expenditure recorded under the three grants accounted for approximately 86%, 65% and 90% of the total funds allocated for the three grants, respectively.[13]

Interestingly, findings from the PAISA school survey for 2009-10 paint a somewhat different picture. According to the 2009-10 data for grant receipt half way through the financial year (October/November when the survey was conducted), 41% primary schools (PS) and 28% Upper Primary schools (UPS) reported that they had not received any of the three annual grants. Only 23% of the PS and 33% of the UPS reported receipt of all three grants. The gap between these findings and expenditures reported by the states can, in part, be explained by the peculiarities of the expenditure reporting system. In the current system, funds advanced by the district to schools are reported as expenditure and adjusted only upon submission of expenditure statements, which are submitted at the end of the financial year and often much later than the end of the financial year. Hence, it is possible for districts to report expenditure under the three annual grants, without schools either having received or spent funds during the period for which expenditure is reported.

What explains delays in receipt of funds, if these have, in fact, been advanced from the districts? Anecdotal reports from schools suggest many possibilities. For one, the current system of electronic transfers is not always instantaneous due to the limited reach of the rural banking network. There may also be other reasons such as limited banking facilities at the ground level which may constrain the capacity of the Head Master to access the school account on a regular basis to check whether money has been credited to the account. Finally, lack of information on the different grants and entitlements that a school gets could also explain these results.

|

As this case study demonstrates, the process of fund transfer is a lengthy and complex one. Funds pass through several layers of the bureaucratic labyrinth before finally reaching the frontline service delivery unit. Complicating the process further is that despite the prevalence of norms and standards to ensure the timely disbursement, delays are often experienced in the allocation of funds from one level to the next. Additionally, there are gaps in the amount of real time information of receipt and expenditure of funds at each level. The causes behind these delays and the specific nature of bottlenecks need to be understood better. To address these problems, there is a pressing need for further research.

[1] Research Analyst with Accountability Initiative, Centre for Policy Research

[2] Manual for Financial Management and Procurement unit, pp.5-50, SSA Portal, see http://ssa.nic.in/financial-management/manual-on-financial-management-and-procurement/manual-on-financial-management-and-procurement-unit/

[3] Manual for Financial Management and Procurement unit, pp. 50, SSA Portal, see http://ssa.nic.in/financial-management/manual-on-financial-management-and-procurement/manual-on-financial-management-and-procurement-unit/

[4] Financial year is divided into four quarters of three months. The first quarter spans the period from April-June, the second quarter includes the period from July-September, the third quarter includes the period from October-December and the fourth quarter spans the period from January-March.

[5] Ibid. 65-77

[6] Although in the books of account they are treated as an advance till utilization certificates are submitted.

[7] Ibid. 65-66

[8] ‘Details of Year wise Releases since Inception for SSA by GOI & GOR’, from details of the year wise releases towards SSA2010-11bhu2/17/2011GOIGORreleasesSSA, obtained from the State project office, Rajasthan

[9] This assumption is supported by the expenditure statement obtained from the SPO Jaipur, according to which funding for all major overheads except allocations for SPO, are transferred to the districts. This includes teachers salary, free textbooks, civil works, school grants, TLE, teacher training, training for community leaders, provision for disabled children, management, innovations, etc

[10] Ibid

[11] Since we are looking at total district figures it is not possible to determine when districts transferred funds to schools because that will vary for each district

[12] State wise component wise expenditure as on 30.09.10, SSA portal, see http://ssa.nic.in/page_portletlinks?foldername=financial-managementibid

[13] Expenditure statement Sarva Shiksha Abhiyan (SSA) 2010-11, December 2010, obtained from State Project Office, Jaipur