Worsening State Finances During COVID-19 Require Course Correction

21 July 2020

The Union government recently announced a special economic stimulus package of Rs. 20 lakh crore under the Atmanirbar Bharat Abhiyan in response to the COVID-19 pandemic.[1] While, among the proposed measures were some for boosting the fiscal health of states, these may be inadequate. With the pandemic, states have faced the dual pressure of low revenues and expanding expenditure commitments to ensure delivery of cash, food and healthcare among other welfare measures.

To understand the emerging trends on their fiscal health, the Accountability Initiative at the Centre for Policy Research analysed the fiscal position of 17 states[2] prior to the COVID-19 outbreak to determine their revenue and expenditure performances (‘Study of State Finances 2020-21’ Working Paper published in May 2020, available here). Our analysis reveals the existent burden on state finances even prior to the outbreak, which can potentially impact states’ ability to respond to the crisis now. This post summarises our major findings.

Although the lockdown has hurt revenues of both the Union and state governments, the burden of the actual battle against COVID-19 and associated expenditure is primarily being shouldered by the states.[3] Funds transferred from the Union form one of the major sources of income for the states. There are two main types of transfers: (a) Tax devolution, and (b) Grants-in-Aid (GIA), which include both Finance Commission (FC) grants and grants for Centrally Sponsored Schemes (CSSs). Among these, tax devolution – a constitutional mandate given India’s federal structure – is a vital source of revenue for states as it forms a source of predictable, untied funds which they can leverage according to their expenditure priorities.

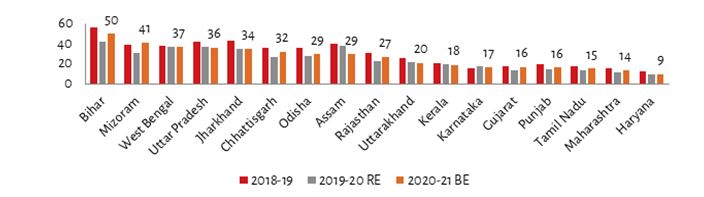

GIA, on the other hand, is available for use at the discretion of the Union government. In our analysis, we found that both tax devolution, as well as, GIA transferred to states before the pandemic were lower than proposed.

In specific, with the implementation of the 14th Finance Commission (FC) recommendations, on average, the share of tax devolution in total states’ revenue receipts had increased from 21 per cent in 2015 to 26 per cent in 2020. A closer look, however, at the actual amounts indicates that there was a difference of as much as Rs. 6.84 lakh crore between the 14th FC projections of tax devolution due to states and actual releases. With the current slowdown in economic activity, the projected tax devolution to states is expected to be much lower than the estimated Rs. 7.8 lakh crore for FY 2020-21.

While all states will be impacted, low-income states such as Bihar, Mizoram, West Bengal and Uttar Pradesh will be particularly hit at this crucial time (as shown in Figure 1).

Figure 1: Share in Union Taxes to Total Revenue Receipts

Source: State Budget Documents

Note: Tax Devolution and Total Revenue Receipts for FY 2019-20 based on Revised Estimates, and for FY 2020-21 based on Budget Estimates

Own source revenues have fallen due to lockdown

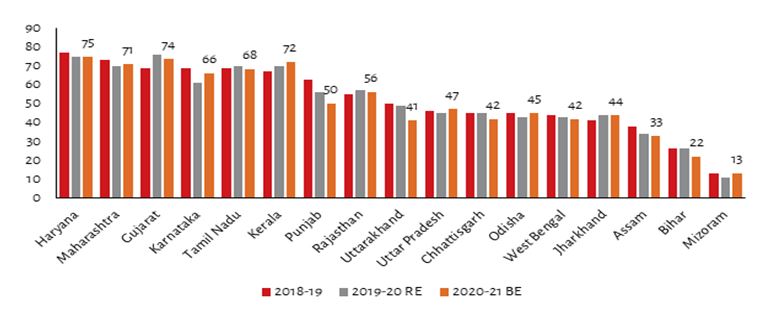

Given the likely fall in the tax devolution, states’ own resources comprise a complementary source of revenue. However, our analysis shows that their Own Source Revenues (OSR) have fallen drastically. According to FY 2020-21 BE, OSR accounted for around 51 per cent of states’ total revenue receipts, the lowest in the last four years.

This will deteriorate further due to sluggish economic activity exacerbated by the pandemic. States that generate the lowest share of their revenue from their own sources will be the worst hit. For instance, as depicted in Figure 2, Mizoram, Bihar, and Assam generate around 13 to 22 per cent of their total revenues from this avenue and are more dependent on transfers from the Union government.[4]

Moreover, states such as Bihar, Chhattisgarh and Punjab, which had already anticipated lower growth rates (below 8 per cent) in their own tax revenues, are likely to encounter further distress in their ability to meet expenditure needs.[5]

Figure 2: OSR to Total Revenue Receipts

Source: State Budget Documents

Note: Own Source Revenue and Total Revenue Receipts for FY 2019-20 based on Revised Estimates, and for FY 2020-21 based on Budget Estimates

To compensate for the loss in states’ own revenue due to recent changes in the tax system, the GST regime has a mechanism in which, if states’ own tax revenue fails to grow at 14 per cent for the first five years since the introduction of GST in 2017, the Union pays out a GST compensation (collected through cesses imposed on goods taxed at 28 per cent).[6]

However, GST compensation to states has recently been delayed. While there were no outstanding payments of GST compensation between the Union and state governments for FY 2017-18 and FY 2018-19, and till the first quarter of 2019-20, delay was seen since August 2019 due to dwindling cess collections. This led to increasing fiscal demand from states due to shortage in their revenues. A sum of Rs. 70,453 crore [7] from October 2019 to February 2020 was only cleared recently, and the Union still owes compensation for the months of March and April (which was due in May 2020).

Concurrently, inflows from another important revenue source for states – Centrally Sponsored Schemes (CSSs) – has proven to be challenging. CSSs are specific-purpose funds administered by various Union ministries to direct expenditure on areas of national priority. The current design of CSSs is such that their planning is centralised in nature [8], which undercuts states’ ability on expenditures based on their local needs.

The acceptance of the 14th FC recommendations also led to a restructuring of CSSs resulting in a decrease in the Union’s share and an accompanied increase in the state share of the CSS budgets. For some states, their share has shot up from 25 per cent to as high as 40 or 50 per cent [9]. This has led to a re-routing of ‘untied’ funds received through enhanced tax devolution which the state governments could use as they deemed fit, into CSS funds.

Finance Commission Grants, under GIA, are important auxiliary revenue resources to local service delivery institutions including Urban Local Bodies (ULBs). As per the recommendation of the 15th FC, the total grants allocated to ULBs is Rs. 29,250 crores in FY 2020-21 BE, which is 10 per cent more than the Rs. 26,665 crore provided for ULBs in FY 2019-20 BE (during the previous FC). Despite this increase in allocation, states have insufficient access to these funds as 66 per cent of the total ULB grants are tied to certain expenditures including on drinking water and solid waste management [10]. Thus, even this route to spend on local needs is not without conditions.

States rely on borrowings to compensate for their shortfall in receipts

So what further recourse do states have?

Our expenditure analysis shows that around 75 per cent of the total expenditure of states was expected to be met through revenue receipts as per FY 2020-21 BE. States would, therefore, need to borrow to compensate for the shortfall in receipts. To provide some assistance to states, the Reserve Bank of India (RBI) increased the borrowing limit under the Ways and Means Advances (WMA) – a short-term loan facility – by 60 per cent. This provides a financial cushion of close to Rs. 51,600 crore for a period of three months [11].

However, these short-term borrowings are unlikely to be adequate to support the longer-term funding needs of the states. The recent increase under the Atmanirbhar Bharat Abhiyan of borrowing limits to 5 per cent of GSDP (up from 3 per cent) also comes with conditions. Of this additional corpus of Rs. 4.28 lakh crore, states can only borrow 0.5 per cent, or Rs. 2,410 crore, unconditionally.[12]

States are, thus, struggling with fiscal flows due to low revenues from tax devolution, delayed GST compensation and the inability to raise their own revenues. This liquidity crisis has posed a serious challenge to the states managing short and long-term impacts of the pandemic.

What can the Union government do?

Our analysis reveals that the state governments are often challenged with inadequate resources to meet expenditure needs, even prior to this crisis. The Union government and RBI have adopted several steps specific to mitigate the additional burden due to COVID-19, some of which have been discussed above.

In the current situation, the government has recognised prodigiously, rising demand for financial resources and the need to use the constrained resources judiciously in accordance with changing priorities. [13] To accommodate this, the government has suspended the already approved schemes for the current financial year. Instead, priority is being given to special relief packages under Pradhan Manthri Gareeb Kalyan Yojana, Atmanirbhar Bharat package.

But, all these schemes come with fixed and tied funds limiting the spending autonomy of states. To further shore up state finances, the Union government can extend support by modifying CSSs in a way that offers greater flexibility. For instance, schemes related to health and food security can be restructured to ensure that states have the autonomy to deploy untied grants to meet their self-determined needs [14]. This can provide an untied resource pool for the states.[15]

The COVID-19 pandemic has imposed substantial human and fiscal costs on states at a time when India’s economy was already constrained. The pandemic and the lockdown have arrested economic activity and impeded the state governments’ ability to create the fiscal space required to mitigate the ensuing crisis. For India to emerge from the COVID-19 pandemic, it is urgent that states are in a position to take autonomous fiscal decisions based on their needs. This is why conditional Union transfers to states may serve to only weaken India’s response.

[1] https://pib.gov.in/PressReleasePage.aspx?PRID=1624661

[2] The states were those that have released their state budgets in the public domain for the current financial year, FY 2020-21: Assam, Bihar, Chhattisgarh, Gujarat, Haryana, Jharkhand, Karnataka, Kerala, Maharashtra, Mizoram, Odisha, Punjab, Rajasthan, Tamil Nadu, Uttar Pradesh, Uttarakhand, and West Bengal.

[3] Accountability Initiative (2020).Retrieved via URL on 11 May 2020: < http://accountabilityindia.in/datacharts/#>

[4] Kapur A., Irava, V., Pandey S., and Ranjan, U. (2020), “Study of State Finances 2020-21”, Accountability Initiative, Centre for Policy Research. Available online at: http://accountabilityindia.in/wp-content/uploads/2020/05/Study-of-State-Finances-2020-21-1.pdf

[5] ibid.

[6] Kapur A., Irava, V., Pandey S., and Ranjan, U. (2020), “Study of State Finances 2020-21”, Accountability Initiative, Centre for Policy Research. Available online at: http://accountabilityindia.in/wp-content/uploads/2020/05/Study-of-State-Finances-2020-21-1.pdf

[7] The Business Standard (2020). “Centre releases another Rs 34,000 cr GST compensation to states, more soon”. Retrieved via URL on 9 June 2020:https://www.business-standard.com/article/economy-policy/centre-to-release-another-rs-34-000-cr-gst-compensation-to-states-soon-120040800818_1.html.(2) Press Information Bureau (2020).“Centre Releases Rs.36,400 Crore as GST Compensation to States.”. Retrieved via URL on 9 June 2020:https://pib.gov.in/Pressreleaseshare.aspx?PRID=1629446

[8] https://www.cprindia.org/latest-policy-challenges/tid/1713

[9] Kapur A., Irava, V., Pandey S., and Ranjan, U. (2020), “Study of State Finances 2020-21”, Accountability Initiative, Centre for Policy Research. Available online at: http://accountabilityindia.in/wp-content/uploads/2020/05/Study-of-State-Finances-2020-21-1.pdf

[10] 15th Finance Commission. Report for the Year 2020-21. Retrieved via URL on 2 June 2020: https://fincomindia.nic.in/writereaddata/html_en_files/oldcommission_html/fincom15/XVFC_202021%20Report_

[13] For more details, listen to the podcast by Bangalore International Centre podcast host Pavan Srinath talks with Economist Dr. Indira Rajaraman. Retrieved from URL on 23 May 2020: https://podcasts.google.com/feed/aHR0cHM6Ly9iaWN0YWxrcy5saWJzeW4uY29tL3Jzcw/episode/YjI5NGViZWItM2M0MS00MTU5LTllM2EtOTFlMzAxNzQxZWU0?hl=en-IN&ved=2ahUKEwiI0NiGiZLpAhVOIbcAHYRmBzEQjrkEegQICxAG&ep=6

[14] https://cprindia.org/sites/default/files/BS%20english%20Yamini%20Aiyar.pdf

[15] Kapur A., Irava, V., Pandey S., and Ranjan, U. (2020), “Study of State Finances 2020-21”, Accountability Initiative, Centre for Policy Research. Available online at: http://accountabilityindia.in/wp-content/uploads/2020/05/Study-of-State-Finances-2020-21-1.pdf

Sharad Pandey and Vastav Irava are Research Associates at the Accountability Initiative, Centre for Policy Research.

This Working Paper has been co-authored by Avani Kapur, Director of Accountability Initiative, Sharad Pandey, Udit Ranjan, Senior Research Associate, and Vastav Irava. It can be downloaded from here.

To cite this blog, we suggest the following: Pandey, S. and Irava, V. (2020) Worsening State Finances During COVID-19 Require Course Correction. Accountability Initiative, Centre for Policy Research. Available at: http://accountabilityindia.in/blog/worsening-state-finances-during-covid-19-require-course-correction/.