This blog is part of a series unpacking the ‘PAISA for Municipalities‘ research which analysed urban local body finances in Tumakuru Smart City of Karnataka. The first part offers why the study was conducted, the backdrop to the study, and the researchers involved. It can be found here.

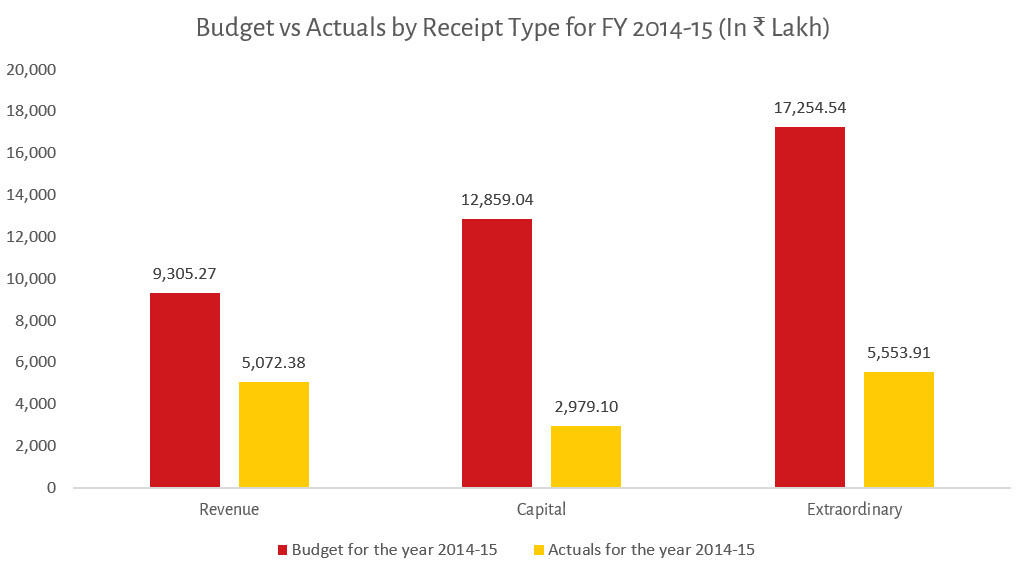

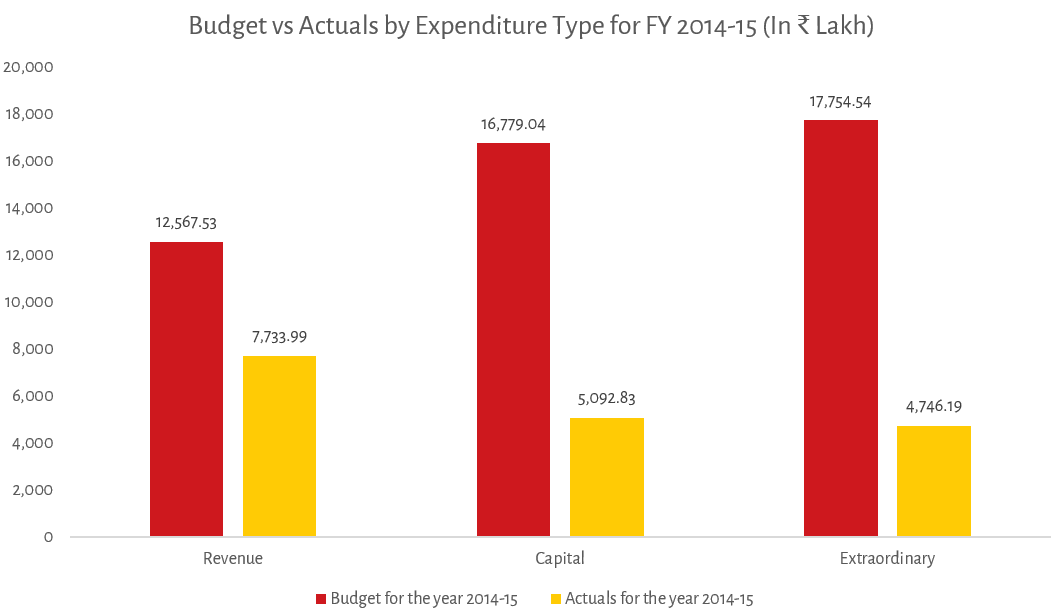

In my last blog, I had described the shortfalls between the allocations budgeted and the funds received by the Tumakuru city corporation. In this blog, I look at the expenditures of the corporation.

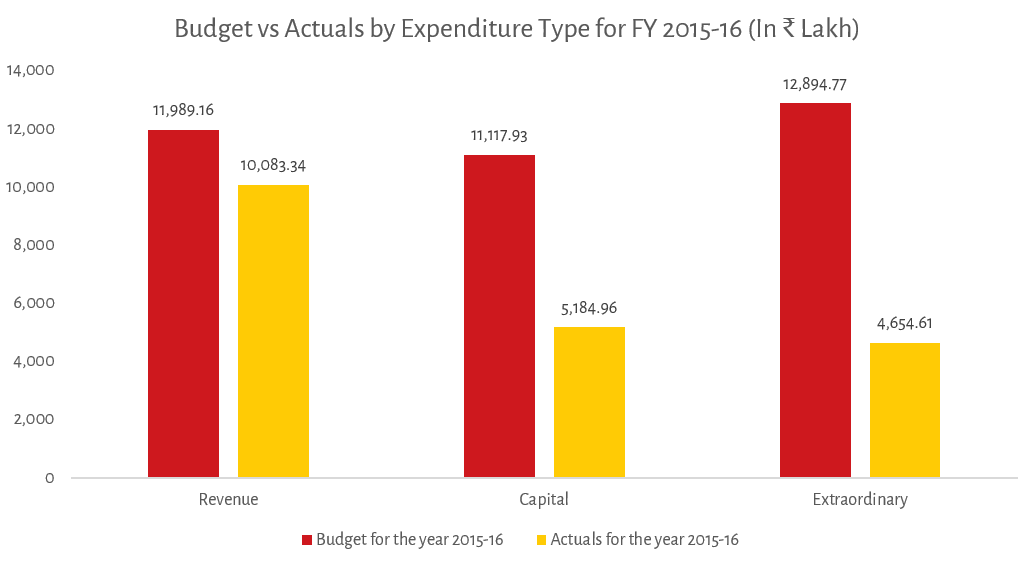

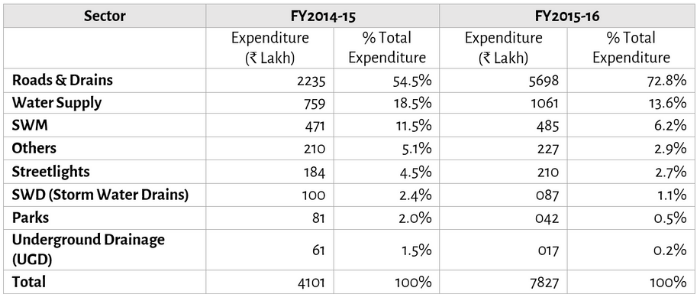

The city corporation spends most of its money on roads and drains. Solid waste management and water supply come next, but in terms of percentage, the share of roads and drains increased in the pie, in 2015-16.

Checking back, we discovered that this jump in expenditure was due to the release of the ‘Nagarottana’ grants by the state government, which carried conditionalities on expenditure. It is interesting to note that the state was making a pitch to include Tumakuru in the list of ‘Smart’ Cities, where the focus remains largely on expenditure on infrastructure, water supply, and solid waste management. However, the least expenditure was incurred on underground drainage and parks in FY 2014-15 and FY 2015-16. The table below gives details of sectoral expenditure incurred in FY 2014-15 and FY 2015-16.

An interesting question to explore is whether citizens are able to keep track of expenditure incurred by the city corporation. A simple point to start would be to ensure that expenditure is reported ward-wise (the city is divided into 35 wards from which one representative each is elected to the city council).

We believed that the citizen’s first concern would be her ward; hence the need to provide ward-wise breakup of the expenditure incurred for each sector, by the city corporation.

We found that ward-level expenditure was indeed available for only the sectors mentioned in the Table above. While this information is not graphically represented or easily made available to the citizen, an industrious one can ask the corporation and we do not doubt its ability to deliver these details.

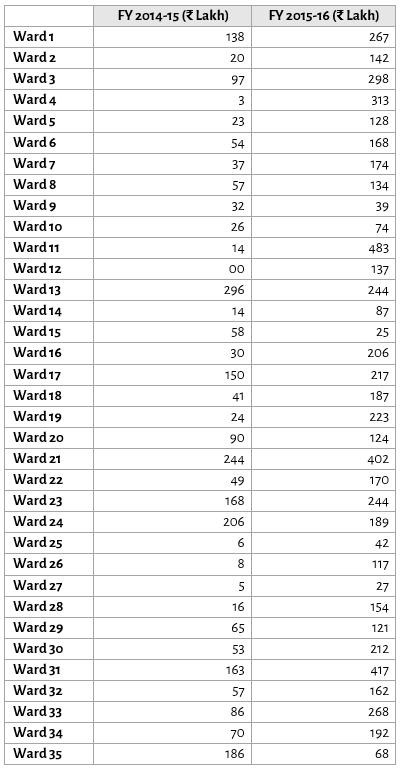

An interesting finding we discovered was that ward-wise expenditure was skewed both within a year and between years. Most wards saw an increase in expenditure from 2014-15 to 2015-16, though those wards that received a relatively higher allocation in 2014-15 (Ward No’s 13, 15, 24, and 35) saw less expenditure in the next year.

The skewed nature of expenditure across FY 2014-15 and FY 2015-16 can be explained by the increased funds transferred to the Municipal Corporation in FY 2015-16, which also explains the corresponding increase in ward-level expenditure. Furthermore, given the nature of expenditure on infrastructure, some of it was concentrated on arterial roads and drains that ran more in some wards than others. The table below provides details of ward-wise expenditure incurred by Tumakuru Municipal Corporation in FY 2014-15 and FY 2015-16.

Whatever may be the reason for the skewedness of expenditure between wards in Tumakuru, the assuring fact remains that citizens who make the effort can obtain data from the corporation, analyse it and ask questions of it.

However, what of the social sector expenditure, one might well ask. For example, would it be possible to obtain details of expenditure incurred on health-related matters, such as during the ongoing pandemic?

That is not possible, at least currently, on a ward-wise basis.

A lot, therefore, remains to be done. There are two choices in how to construct a smart, ‘Smart City’ information system. The more difficult, but more enduring solution is to ensure that institutional design is not so fragmented. If the city corporation becomes the owner of all the expenditure incurred in that area, the city corporation’s budgeting and accounting system will capture all details — our finding is that it is robust enough to do so. But turf rivalries and a reluctance to undertake functional and fiscal decentralisation in the way it ought to be done, makes that a remote possibility.

As an alternative, a ‘Smart’ budgeting and expenditure reporting system should be designed in a way that captures budgets of all spending entities in the Smart City’s jurisdiction along with the schemes and expenditures incurred, down to the ward-level.

The first step in this direction is to introduce changes in the Municipalities Act that makes it mandatory for all entities that spend money within the jurisdiction of the Municipal Corporation to provide in the public domain information on their ward-level allocations and expenditures. A similar mandate was laid down in the Karnataka Gram Swaraj Act in 2016, entitling every Gram Sabha to know all expenses undertaken in the jurisdiction of the Gram Panchayat.

A similar clause in the Municipalities Act mandating all expenditure entities to make their budgeting and expenditure data available at the granularity of a ward, will be a breakthrough legal provision. Naturally, technology will have to serve this law. Technology will eventually enable all ward-level allocations and expenditures by all implementing entities to be reported by them in real-time.

T.R. Raghunandan is an Advisor at Accountability Initiative.